Samantha Stokes, a first and initial time homeowner, stands in the front off their unique the Eastern Garfield Playground family one she offers together with her adolescent d. Stokes is the basic individual personal to the property since section of a special system the new Chi town Property Power is running out to possess earliest-go out homebuyers. | Tyler Pasciak LaRiviere/Sun-Minutes

Whenever Samantha Stokes’ child went to their the fresh new East Garfield Playground household for the first time, new adolescent shot to popularity their own footwear and you may ran around the house.

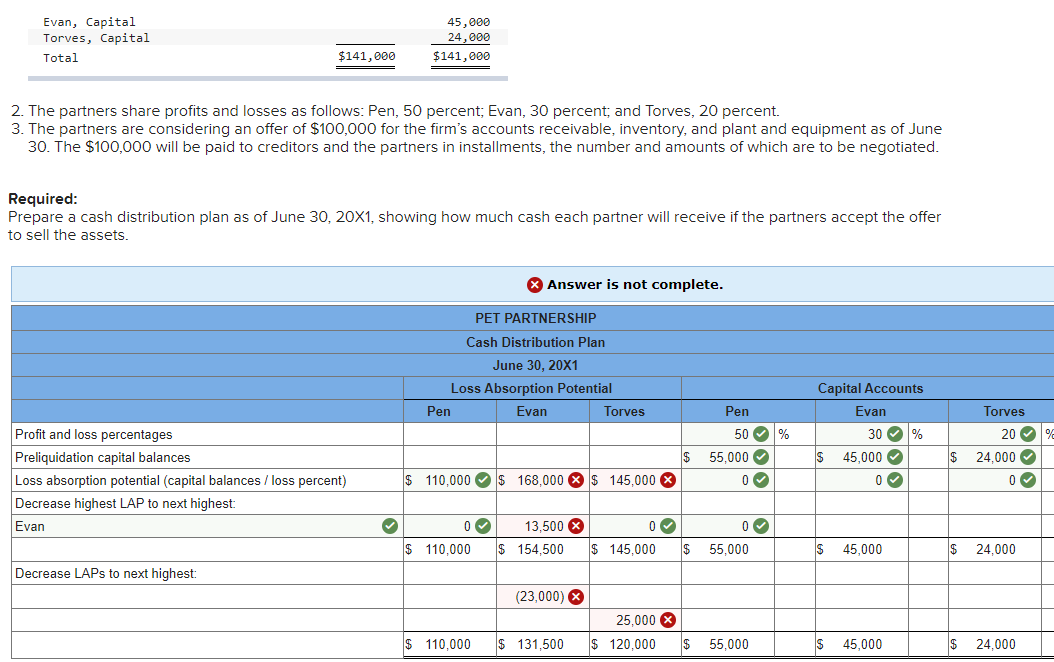

Participants should also have about $step 3,000 in the deals

Therefore the initial thing, she goes to see the huge backyard that people have, in addition to garage and you can things such as you to due to the fact this woman is never really had you to prior to, Stokes appreciated. It actually was just adventure on her behalf face, plus to this day will still be unbelievable I am a genuine resident.

Regarding four weeks back, Stokes, 38, finalized on her behalf very first house for herself and her 14-year-old child. She become examining to order a property this past year immediately following she read her housing selection discount from the Chi town Casing Authority would almost certainly stage out due to the fact a current occupations promotion enhanced their income.

Stokes was a student in the procedure of protecting property from agency’s Love to Own program in the event the department informed her from the the Advance payment Assistance Program they certainly were establishing that would render a grant of up to $20,000 getting a deposit and you will settlement costs. Stokes told you it decided the greatest storm – from inside the a great way.

I happened to be therefore romantic into the the brand new closure go out off my family, they ended up exercise well for my situation, she told you.

Samantha Stokes, a primary-date homeowner, really stands throughout the lawn of their unique the brand new Eastern Garfield Park household you to definitely she offers along with her adolescent child on the Thursday. Stokes is the first individual close into a house since element of an alternate program the brand new il Casing Authority is actually rolling away to own first-big date homebuyers, brand new Down payment Guidance System.

Stokes is the agency’s basic participant to shut with the a property as part of the the deposit recommendations program. The latest $20,000 could be forgivable just after 10 years.

You will find already over several almost every other people at the rear of Stokes who were considered eligible for new grant and so are in the procedure of buying a home, told you Jimmy Stewart, brand new director off home ownership for CHA.

The fresh agencies methods it could be in a position to help regarding 100 participants payday loan Huntsville regarding the program’s first year, Stewart said. The application form is funded as a result of federal funds from brand new You.S. Institution from Casing and you may Urban Invention.

When you’re Stokes got a casing coupon through the homes power, Stewart told you the program are accessible to some body – in addition to those people way of living outside of Chicago – provided our home purchased is in the city’s borders.

But not, the program does include most other qualifications requirements, such getting an initial-time homebuyer that will use the property because their number 1 quarters, the guy said. Concurrently, recipients’ income should not surpass 80% of the area average income.

This means an individual adult’s earnings can be during the or reduced than simply $61,800, and you can children off about three have to have a family of income from or lower than $79,450.

New construction authority would want the application to aid coupon people who happen to be nearing 80% of town average earnings, meaning he or she is receiving quicker guidance but may be skeptical off seeking homeownership, Stewart said. CHA owners just who create right above the 80% endurance on account of transform to their money is always to nevertheless incorporate, especially because they are probably to the brink off losing a beneficial voucher otherwise property direction.

The program arrives because mortgage prices consistently raise along the country. 57% earlier this times, this new Related Force said.

As a result of the weather that we can be found in with regards to mortgage loans at this time and other people venturing out to homeownership, Stewart told you, we believe that the places all of them within the a competitive virtue and you can allows them to manage to purchase the house and also have enjoys a reasonable month-to-month mortgage number that is truly achievable as opposed to CHA assistance next.

Stokes acquired $20,000 about new houses authority program, and additionally a separate $ten,000 of a different recommendations system. She along with made use of $5,000 away from her own savings to shop for south west Side, contemporary unmarried-house, and that created altogether she had simply over 15% of the total price of the property.

She in past times lived in a little a couple of-room apartment, although brand new home now offers extra space to own by herself and her daughter. Stokes said she’s settling into the their home detailed with a great bigger home in which she currently envisions youngsters playing around during the coming loved ones rating-togethers. An in-tool washer and you may more dry form she no more should create trips into laundromat.

Their unique brothers and you can dad features offered to make needed solutions, although home is another type of construction. Their particular mommy, just who life close, was a consistent visitor.

Each of them have to select the other rooms and you will say that is the room after they become more, she said.

The speed having a thirty-year home loan rose so you’re able to seven

Samantha Stokes, an initial-date citizen, stands from the cooking area from her the fresh East Garfield Playground household that she offers with her adolescent daughter. Stokes ‘s the basic individual romantic with the a home as the part of a separate system the il Casing Authority was running out to own basic-go out homeowners.