cuatro. Balloon amortization

Contained in this means, you create shorter contributions towards focus and you will dominating throughout your loan’s name. But, in the long run, a large fee comes from protection the rest harmony. This approach cuts back your month-to-month load however, needs mindful planning you to last benefits.

Best explore circumstances: This is certainly ideal for a residential property financial investments otherwise small-term financing for which you anticipate a serious lump sum about coming to cope with the last fee.

5. Round amortization

Inside bullet amortization, you have to pay regular interest for the loan title, on the whole dominating owed once the a lump sum payment during the avoid. This process is far more well-known during the corporate funding and you can securities, in which individuals anticipate a life threatening dollars influx to purchase finally payment.

Ideal explore instance: Perfect for people or projects expecting a giant payment in the prevent of loan term, going for independency to cope with earnings into the financing several months.

A keen amortization agenda Excel layer will likely be a game title-changer for mortgage payments. It simplifies your own commission construction and you can has you worried about the financial specifications. Let’s have a look at amazing benefits associated with eg a routine!

Summarize this short article that have AI ClickUp Notice not only saves you precious time by the immediately summarizing posts, additionally leverages AI to connect their tasks, docs, anybody, and a lot more, streamlining your workflow particularly no time before.

Benefits associated with Performing an Amortization Plan

Wisdom your bank account surpasses number to creating informed choices. That efficient way to achieve that are doing a keen amortization schedule-your strategic device for taking control over debt coming.

- Acquire quality: Observe how for each and every unexpected commission breaks to your dominant and focus, demonstrating just how your debt decrease over time. This understanding makes it possible to track how you’re progressing and you will manage your debt

- Package finest: Enjoy coming money and you may allocate funds effortlessly. Once you understand the percentage quantity and due dates enables you to avoid shocks and you may regular your hard earned money disperse

- Destination ventures: Select possibility for extra payments, enabling you to chip away at the obligations smaller. That it call to action can lead to extreme notice offers

- Song specifications: Utilize the schedule since the helpful information for the financial goals. Celebrate success in the process to keep up motivation and union

- Reduce worry: Once you understand how much cash you borrowed from whenever costs try due instills count on and decrease stress associated with mortgage government

- Improve credit history: Make consistent, on-time loan money given that detail by detail in the plan to help you impression their credit history absolutely. Through the years, a high rating opens up doors to have most readily useful borrowing from the bank terminology and lower interest levels to possess future money

What’s better yet? Starting financing amortization desk inside the Do just fine makes you to change installments and you may frequencies to meet your needs.

Synopsis this post with AI ClickUp Head just helps you to save precious time from the instantaneously summarizing blogs, what’s more, it utilizes AI to get in touch your own work, docs, some one, and much more, streamlining the workflow such as never before.

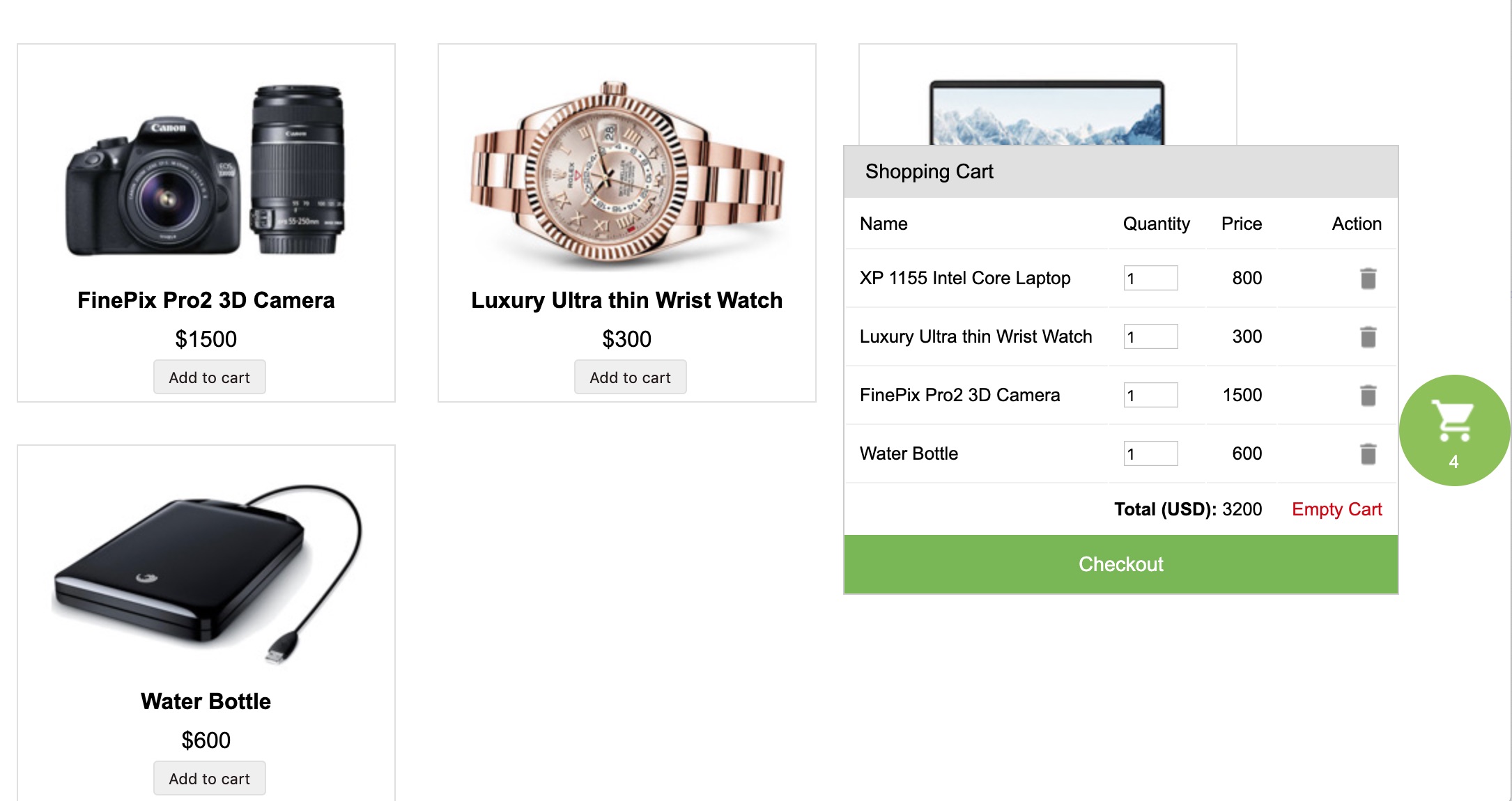

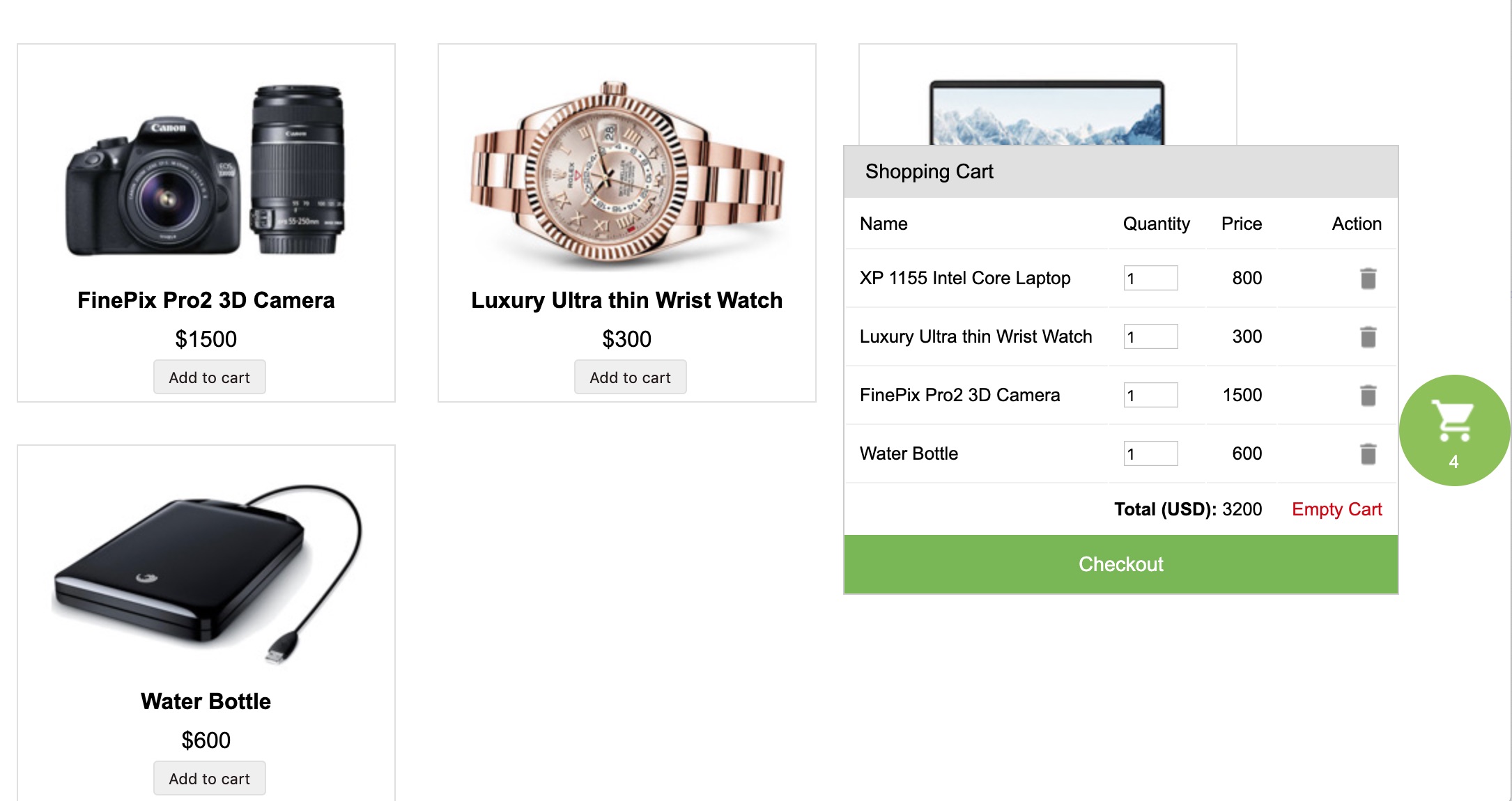

Carrying out a keen amortization schedule in Do just fine can help you track your repayments and you can know your loan construction. Stick to this step-by-action guide to set it efficiently.

1: Developed the amortization table

Open a unique Excel piece and create input muscle towards identified components of the loan. Right entries are very important to possess best data. Include:

- Yearly interest (AIR)

- Loan months in years (LPY)

- Number of costs per year (NPY)

- Loan amount (LA)

Such as for instance, guess you may have an entire amount borrowed away from $5,000, mortgage loan away from cuatro%, and you may a payment age of 12 months. Just create these types of thinking on the designated tissue in order to put this new groundwork to own building your amortization table.