Courtroom Buy A lawfully binding choice provided by the a judge one need a party to accomplish or refrain from doing a specified act.

Covenant An authored contract otherwise pledge constantly under secure between dos or even more events for the results off an action. When you look at the mortgage broker, they refers to the clauses for the home financing agreement one set the legal rights and loans wanted to by the borrower therefore the financial.

Examine Space A type of basis that’s normally faster inside height than simply a cellar. Crawl room aren’t significant enough to bring habitable area for play with by building residents nonetheless they is accommodate particular parts of this building structure.

Borrowing from the bank Bureau A company that accumulates, suggestions, areas and distributes credit and private go out files so you’re able to subscribed lenders (creditors) to own a fee.

Credit history A mathematical expression predicated on a mathematical investigation of a person’s borrowing files and therefore means the creditworthiness of this people.

Consult Term An option securing and you can benefitting the lending company giving towards the bank to help you request instantaneous fees from that loan when you look at the full

Most recent Houses Statement A legal document produced by a secure surveyor one to clearly depicts the limits from a property while the place of developments into the house relative to the fresh new boundaries. In addition it illustrates other issues impacting the home, such as for example liberties-of-means, easements, encroachments, etc. Simultaneously, it could contain a beneficial surveyor’s view otherwise inquiries of these items.

Customer This new team so you’re able to a real home exchange that isn’t being depicted of the a realtor. As per the Rules, a buyers are someone who has actually called, yet not involved otherwise employed market affiliate https://cashadvanceamerica.net/installment-loans-or/ to include characteristics.

Problems Economic settlement which is given of the a courtroom within the an effective municipal action in order to an individual who might have been harmed from wrongful carry out of some other class.

Coping Describes the activities regarding the supply of features getting obtaining, discussing and you will gathering financing linked to mortgage deals. So you can bargain in mortgage loans, someone require a permission about Real estate Council from Alberta, unless of course they are exempt pursuant toward A home Work or the actual Property Act Different Control.

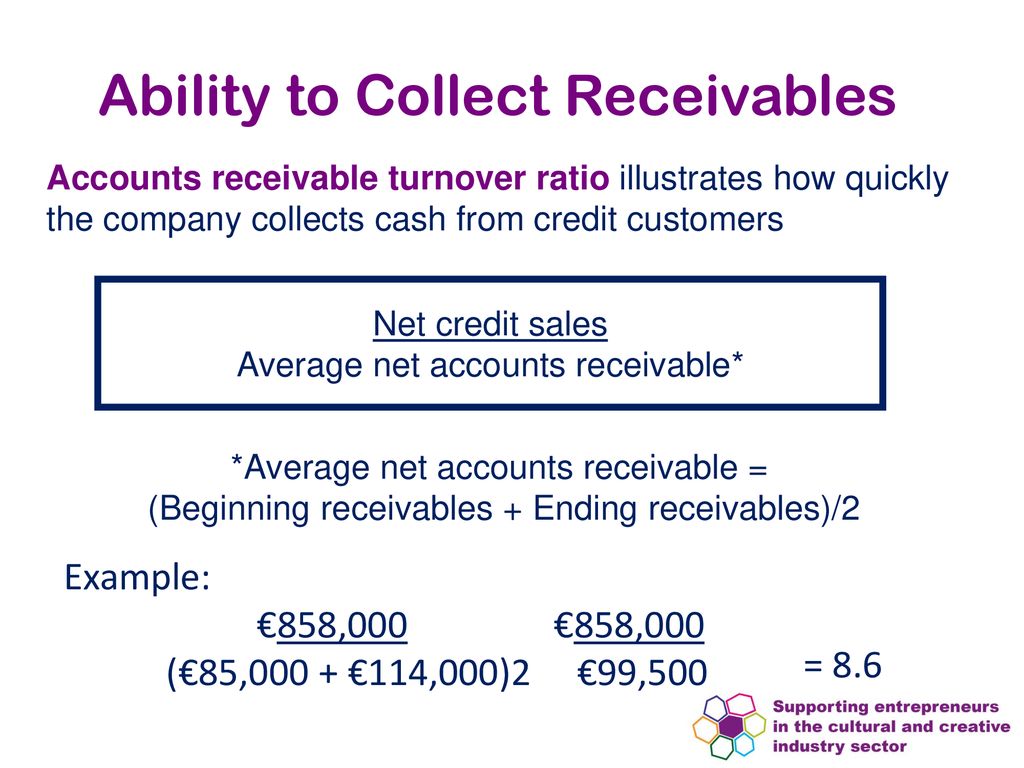

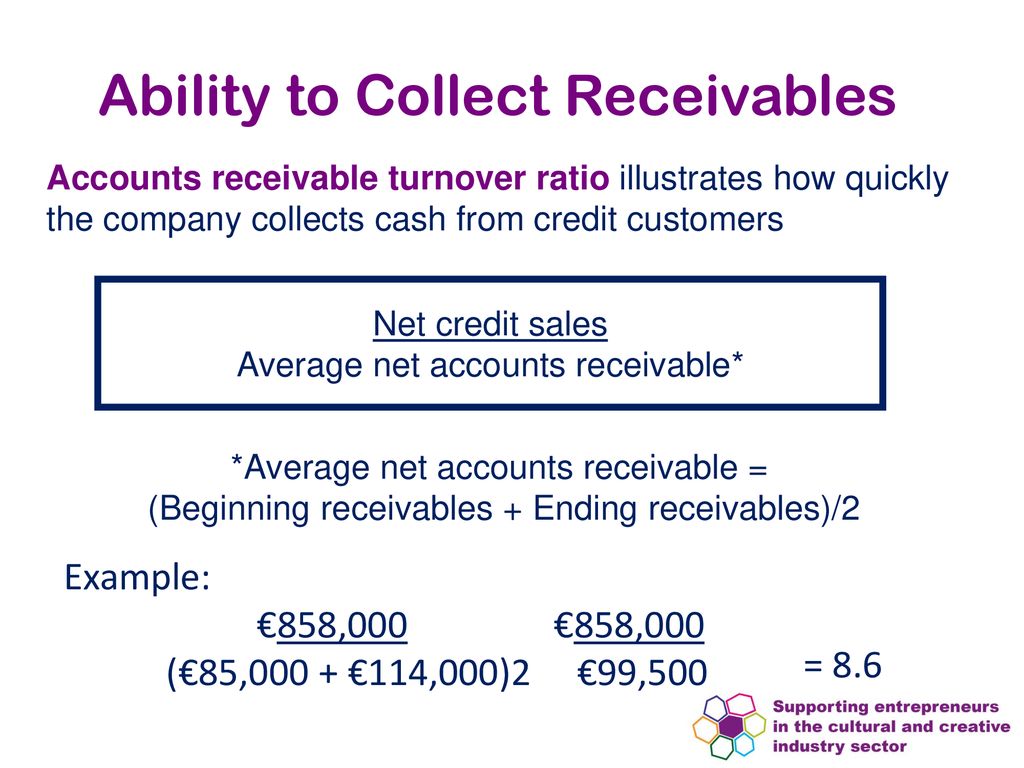

Financial obligation Proportion An assessment of the overall monthly installments of good borrower’s personal debt so you’re able to their particular money. It is accustomed see whether the new debtor are able to afford the newest debt responsibility.

Borrowing Arrangement A legally binding deal between a borrower and you can financial which has terms of installment, brand new charge, almost every other costs, plus laws and regulations and needs of the loan

Standard Fees A fee enforced towards the a borrower just who doesn’t build a repayment whilst will come owed less than a cards contract or whom fails to follow almost every other obligation significantly less than a great credit contract, however, doesn’t come with desire towards the an overdue commission.

Delineated Vehicle parking Appears A kind of rented parking appears who has started represented for the an effective Condo Package, generally using dashed traces. Delineated parking stand can be transfer towards the sales of your own related device in place of first getting recognition regarding Panel out of Administrators.

Delineated Storage area A form of rented space for storing who has become portrayed to your good Condominium Bundle, normally using dashed lines. Delineated shops areas can be transfer towards product sales of the related unit instead of first getting recognition on Panel out-of Administrators.

Demand Page An official letter usually drawn up by the lender’s attorney, below a mortgage foreclosures, saying a legal allege and you will demanding immediate payment of one’s debt. Brand new letter plus lines the specific terms and conditions and you can period of time so you’re able to perform the obligation without having to be taken to legal. Select as well as Foreclosures.