Must i make a joint app? Naturally, it’s not necessary to handle everything alone in daily life, especially with potential such as for instance combined funds to possess lovers available to choose from.

Whether it is way of life will cost you, lease, otherwise insurance when you find yourself in the a love, your money will work together as one.

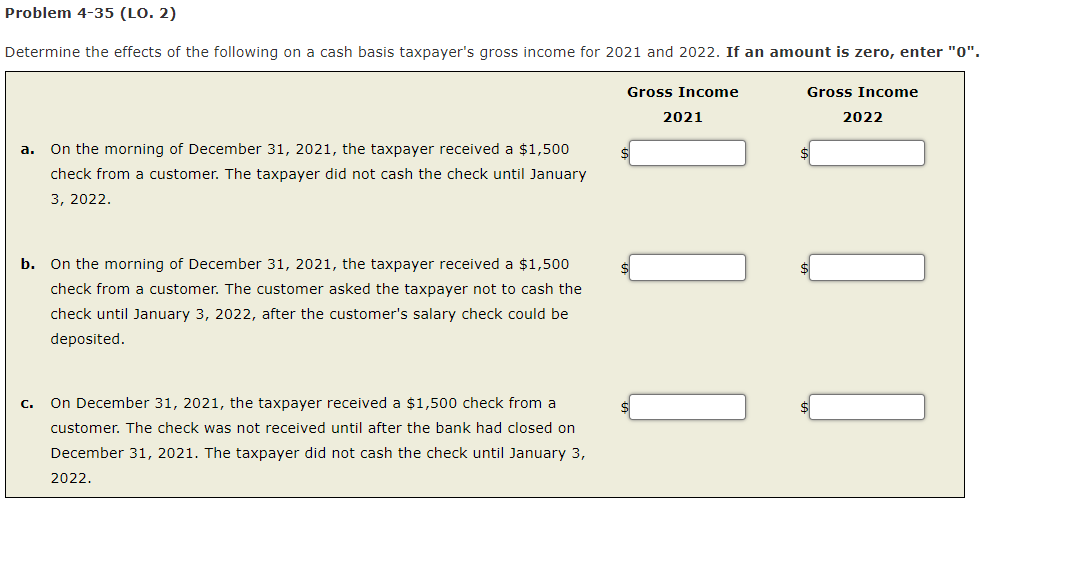

If you are looking in order to borrow money-especially if you’re planning to spend they to each other-it is only logical which you use together too. It is they how to obtain?

Within this guide, we shall safeguards everything you need to discover trying to get joint money to own partners. This consists of the huge benefits, secret facts to consider, and how to begin your application.

Exactly what are joint fund having partners?

A joint mortgage is very much similar to a consistent loan, simply a couple are included for the app in lieu of you to.

A couple of may want to make a shared loan application getting loads of causes. Some of the most well-known were:

- If you want to spend the money on something that’s to own both of you, particularly a motor vehicle, holiday, otherwise and make renovations;

- If an individual people cannot become approved for a loan to their own;

- If one person is unsure they shall be capable remain right up payments on their own;

- If you are looking to obtain a high count than certainly you is likely to be supplied yourself.

Just how can combined money works?

Basic, you decide on a loan provider, to make a software. The lending company will then focus on an arduous check up on your own borrowing from the bank report to see whether you are eligible. Since the mortgage is eligible and also you undertake the fresh new terminology, obtain the money and are needed to pay off the debt into the an agreed selection of month-to-month repayments. Once the obligations was paid, together with one attention or a lot more charges, the account could be finalized.

The big change with respect to shared loans for people is that you result in the app to each other. This means the financial institution is going to run a painful credit assessment on the both of you, comparing the application due to the fact a combined whole.

When you find yourself accepted and you may take on the loan contract, additionally, it means that you’re as you liable for the brand new personal debt. This area specifically is essential to keep in mind.

Who’s accountable for mutual financial obligation?

If you have shared responsibility to have an obligations, this means you are either and you can in person responsible for an entire number-not just your own half. If a person of you finishes paying your debt for any reason, additional remains prone to pay it back all.

Ergo, it’s important to correspond with your ex, agree on just how some thing work, and make sure you’re on a similar page.

Great things about mutual money to possess people

- May help you to locate recognized, should your companion provides a strong credit history;

- ount;

- Will help build controlling month-to-month costs much easier, in the event the two people was contributing.

Cons away from joint fund for couples

- Youre each other responsible for settling a complete amount, not only your own 50 % of;

- All of their credit ratings will suffer in the event the mortgage money try missed;

- You continue to need pay back your debt for those who end the relationship.

Was joint money to own married people different than if you’re not hitched?

There is no difference in taking out a joint mortgage just like the a wedded pair, or you commonly inside the a romance after all. In the course of time the job depends on the combined credit score and you can earnings, and each other end up being prone to repay your debt.