To shop for property Because a federal government Staff

Could you be an authorities worker preparing to get a house? The whole process of to shop for a different home may seem intimidating. On the best resources, you can be certain that a profitable funding and one the place you can get cut thousands of dollars due to becoming a government staff member. Let’s dive on the all property info you really have whenever working for the government!

All of our real estate company is found in the state money off New york, Raleigh. We’re no complete stranger to help you permitting those who benefit the regulators get a hold of great house and use the newest resources open to them! Specifically if you are an initial-big date homebuyer.

Exclusive Demands a national Employee Face

Regulators workers are individuals who are employed in local, state, or national businesses. When you’re involved in this particular area is rewarding, additionally provides economic pressures. Income constraints or regular actions makes homeownership look from visited – that’s what we have been here having! In order to make your house get easy and successful.

Who is a government Employee?

For many who work in societal education, healthcare, or disaster government, you may be a government employee. Post carriers and armed forces professionals and qualify since government staff. An identical is true for group from inside the national areas or discover construction teams.

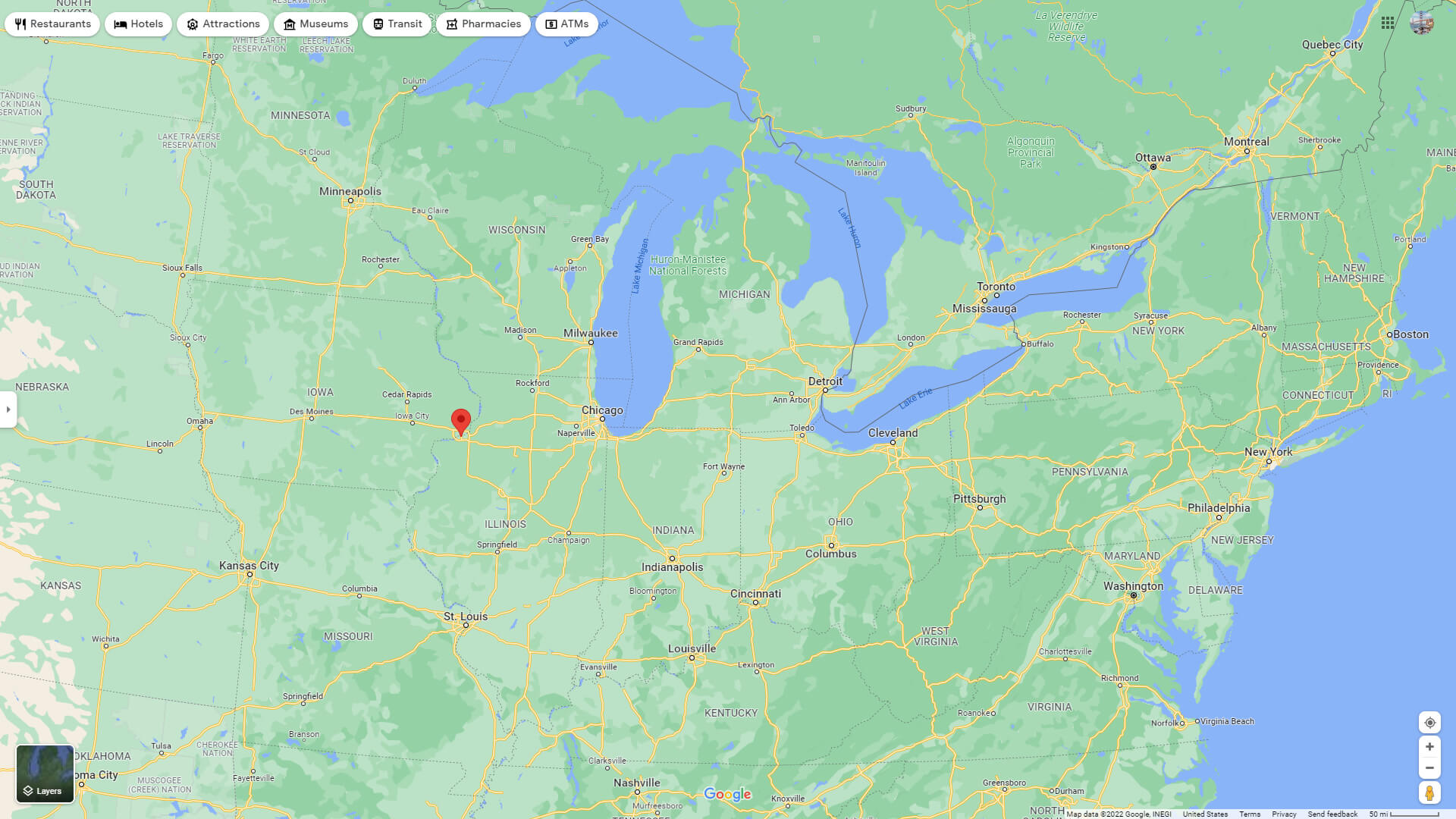

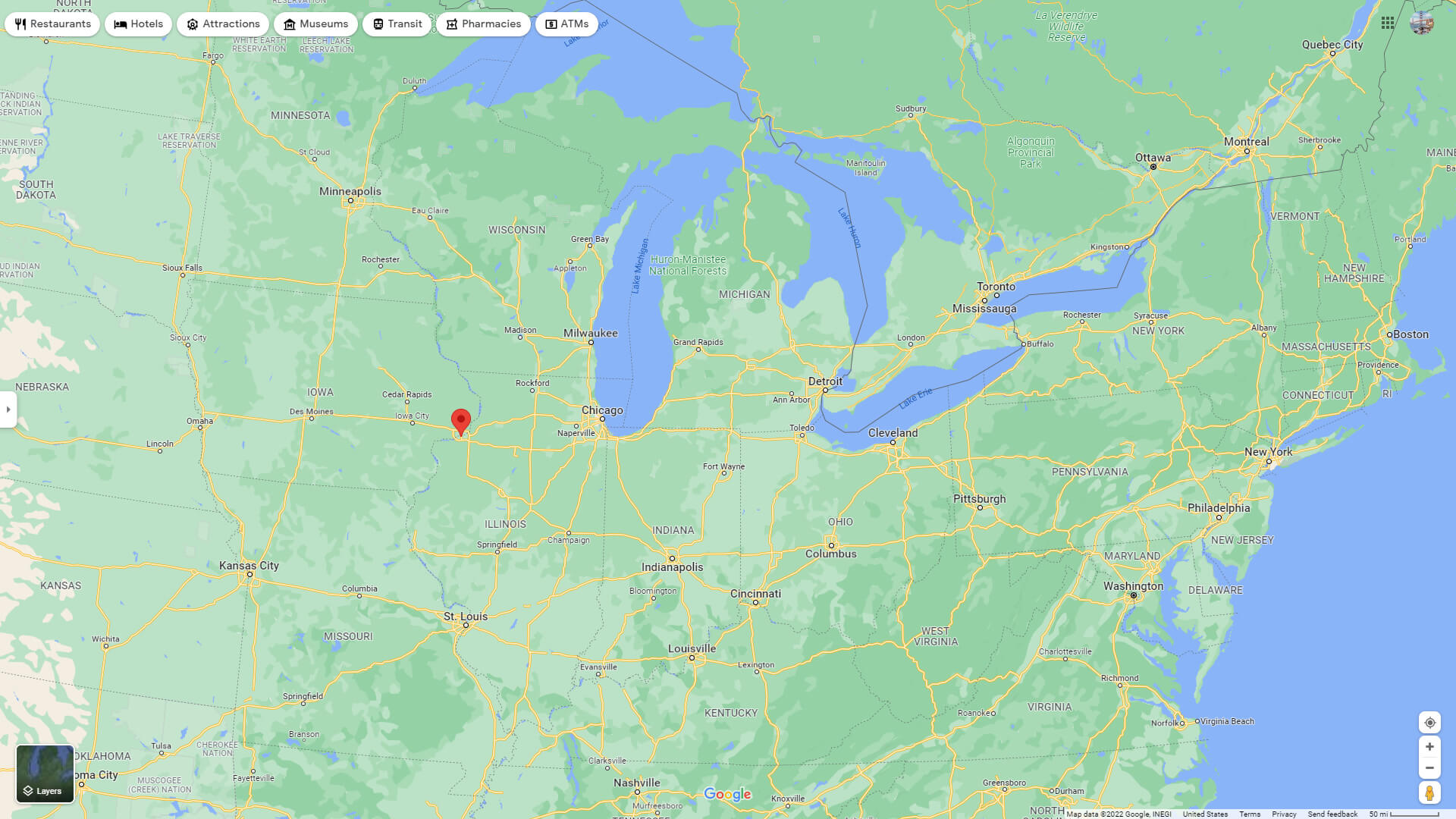

You can assume that very authorities teams operate in the nation’s financing. However, 85% out of authorities employees works beyond your country’s capital.

Income Limits Get Restrict your Selection

In certain specialities, this new salary get lay a government employee from the an economic www.paydayloancolorado.net/lochbuie/ downside. Working in preparing food or janitorial features, for-instance, can make spending less hard. This type of bodies perform can get indicate that you lack the fresh new tips in order to spend the money for down-payment to possess a house.

Authorities efforts can get pay less than work on the individual business. You’ll keeps foreseeable era, however your bank account may not build as frequently.

Your job Location Get Changes Seem to

For individuals who work with new military or another department away from protection, you may need to change towns will to suit your work. This means that it is more difficult understand a location neighborhood better just before selecting home.

Switching metropolises can make they feel like investing a house actually worth the work, also. With anything from protecting that loan so you’re able to writing on the house examination, a house consumer has plenty to cope with.

Remember that home ownership will help help make your property, even if, and buying a house throughout the right place have a tendency to put you up to own coming achievement. You might lease our home out over renters who spend your own financial and debts whilst you continue to build your house.

Be aware of the Economic Benefits of Homeownership

Homeownership may seem like it pertains to moving through numerous hoops. But inaddition it provides enormous economic advantages. Off strengthening riches to creating income tax deductions, you get much once the a citizen.

Create Guarantee

Any time you generate a mortgage percentage, your generate guarantee of your house. Contemplate equity while the amount of cash your home is well worth after your balance is subtracted.

In case the house worth goes up and you initiate settling the newest loan’s dominating harmony, that yields security. Keep in mind one to security isn’t the sort of riches you to expands quickly.

Generate Foreseeable Monthly premiums

If you find yourself a tenant, you’re susceptible to a landlord. You can see your book costs increase each year. Therefore are not building equity in the process.

Given that a citizen, you have got additional control over the way you map the latest monthly payments. If or not you possess a small house in city or lakeside assets, you always can ascertain what your homeloan payment is actually. You can also manage to run your lender so you can to evolve it as pricing alter.