Inside the August, first casing cost inside the level-that towns and cities decrease 4.2% year into the year. Of your own five level-that metropolises, only Shanghai spotted an increase in rate (4.9%). To have 2nd- and you may 3rd-tier cities, freshly based housing cost dropped by 5.3% and you may 6.2% year on the seasons, respectively.

In addition, in the August, secondary construction cost into the tier-you to definitely metropolitan areas dropped nine.4% seasons to the seasons. Prices were losing across the board into four level-one locations. Additional construction prices for the second-level locations refuted 8.6% seasons to the 12 months plus 3rd-level towns 8.5%.

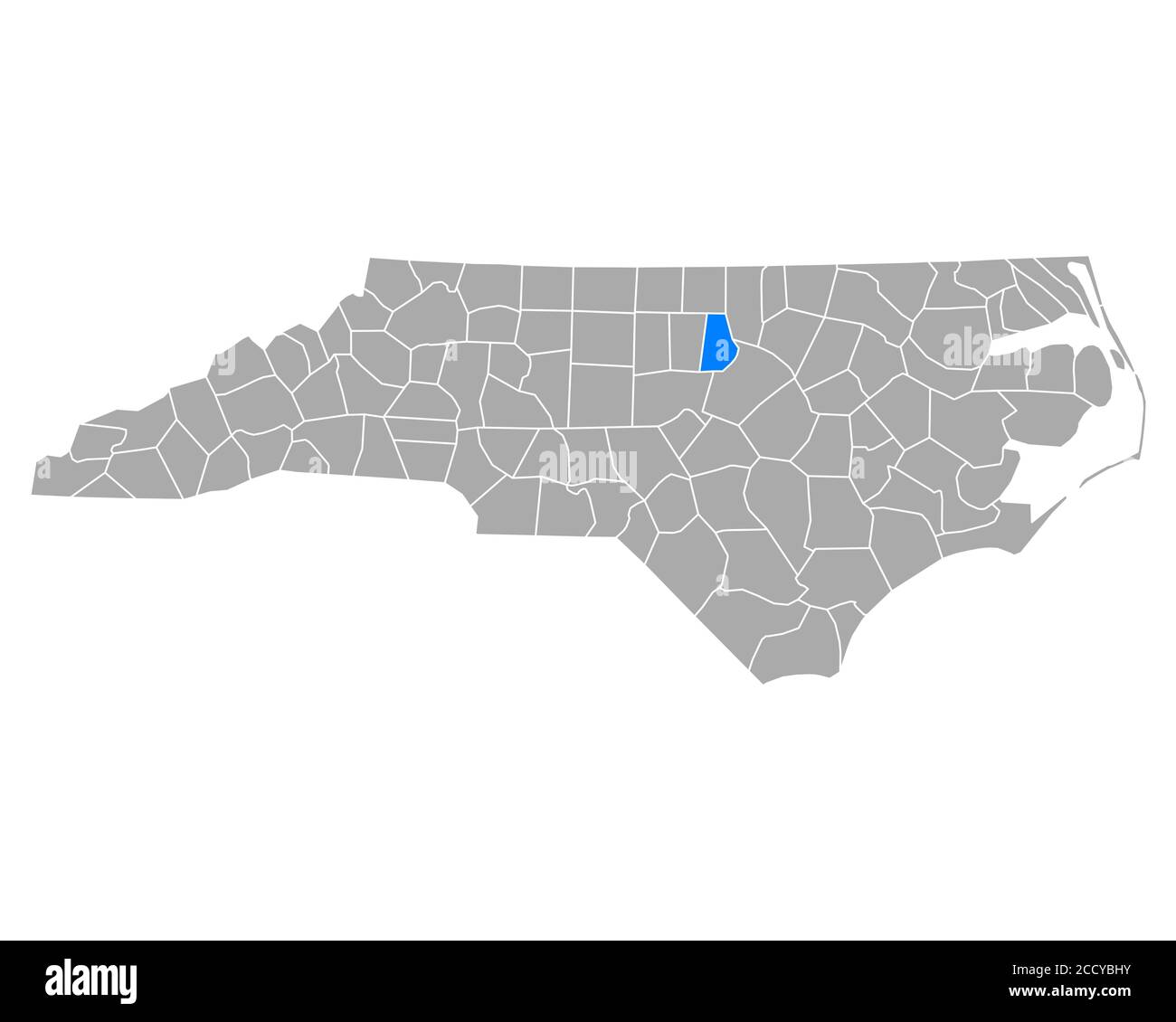

Chart 2

The new Federal Individual Trust Index reflects an excellent slump when you look at the consumer believe because 2022. This refuse aligns on the fall-in secondary home prices, which began during the early 2022 for level-a few and you may level-about three metropolises, and soon after inside 2023 to have tier-you to definitely metropolitan areas.

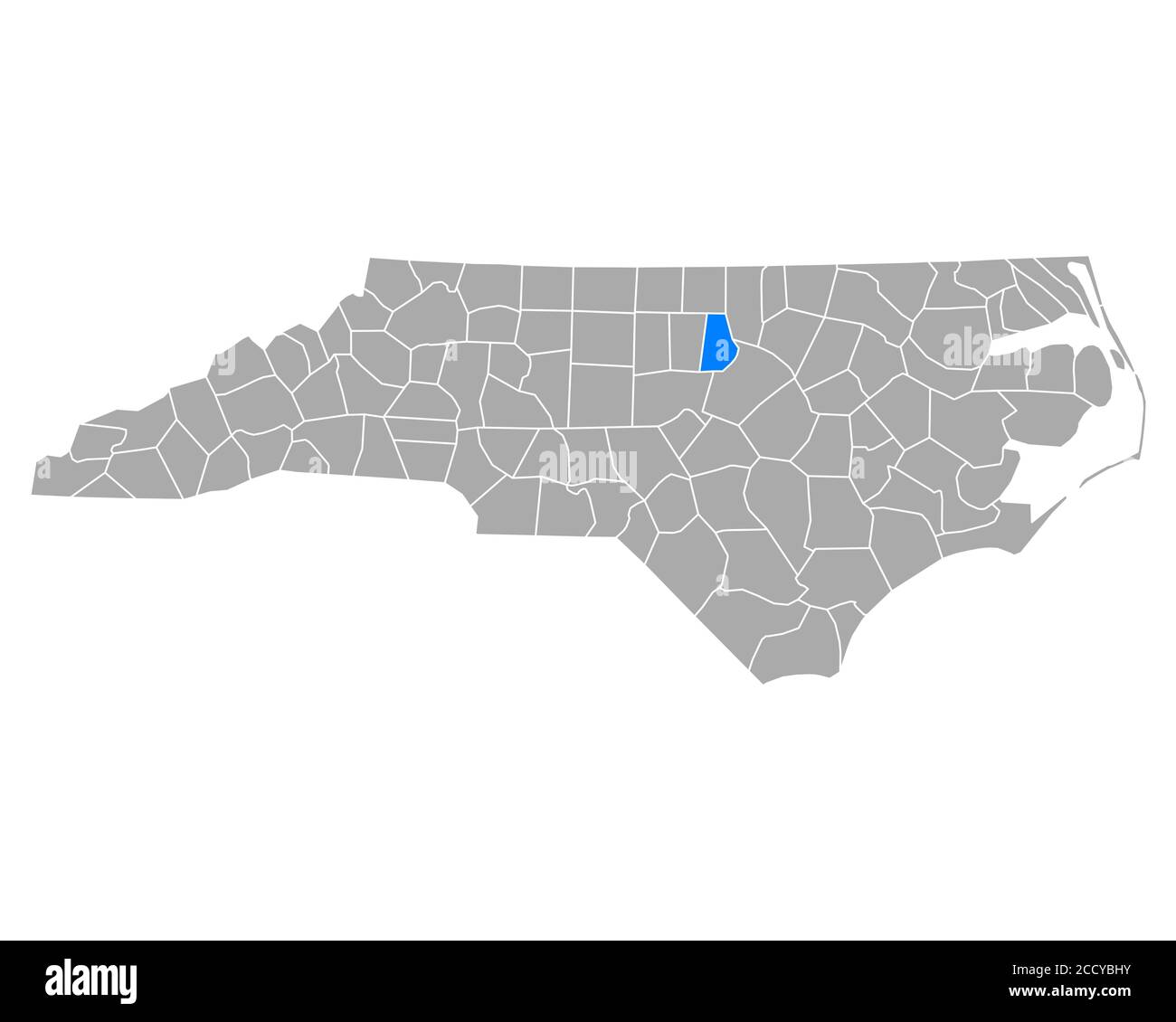

Chart step three

Analysis out-of Asia Real estate Recommendations Corp. (CRIC) reveals that conversion process stayed poor within the September, that’s an usually strong few days to own property conversion. Property conversion process out of China’s ideal 100 developers shrank 37.7% year on the year into the month. 12 months up until now up until Sep, property conversion process of top 100 developers has actually fell thirty six.6%.

not, pursuing the government put out an insurance policy plan in order to activate the savings for the later September, possessions transformation during the picked towns and cities leaped during the national escape week in the first month out of October. Centered on CRIC, number one property conversion area in the twenty two significant metropolises, which happen to be primarily large-tier locations, spotted a beneficial 26% year-on-seasons raise when comparing to new federal holiday week inside 2023.

Towards , the new Chinese government put-out an insurance policy package aimed at ensuring adequate liquidity in the economy. The box included a beneficial 50-foundation area loss in new banks’ necessary set aside ratio and good cut in coverage cost. Additionally boasts PBOC effort to help you shoot RMB800 billion exchangeability for the the market.

The federal government including implemented formula especially targeting payday loans Providence the house field. This type of guidelines incorporated reducing mortgage pricing to possess established mortgage loans and you will reducing the new down payment conditions getting next homes, it is therefore just like the necessity to own very first homes.

In addition, the thus-called “16-part package” and also the relaxation out of guidelines regarding how builders can use proceeds off industrial-property fund was in fact extended up until 2026. In terms of a good relending facility locate established accomplished stocks getting social construction use, government entities announced your PBOC would finance the whole amount to RMB300 billion.

For the late , five earliest-tier locations subsequent raised particular otherwise the purchasing limitations. Additionally, most towns and cities will no longer separate ranging from ordinary and you will low-normal construction. The second is generally a lot more superior casing which need higher worth-additional fees getting reduced because of the both developers and you can homeowners.

Into the , the fresh Ministry of Housing and Metropolitan-Outlying Innovation, Ministry from Loans, Ministry from Pure Info, new PBOC, and you can Federal Financial Regulating Administration revealed the newest steps so you’re able to balance out new possessions markets. These types of brand new methods become supporting the reent of 1 billion urban town and you will dilapidated property equipment. Which service could be given thanks to financial settlement to help you customers.

The government in addition to announced the credit limit approved to own white-number property projects will be longer to RMB4 trillion by end-2024, away from RMB2.23 trillion as of middle-.

Brand new Policies Offer Zero Magic bullet Having Developer Believe

Inside our examine, it entails time for the government’s rules to filter out into the giving support to the full property market. In case the bodies will continue to focus on service getting developer funding and you may destocking, we feel possessions sales and you will pricing you certainly will balance into the the following half 2025.

In the meantime, the latest cautious means certainly one of builders into acquiring residential property and you may initiating this new methods suggests deficiencies in confidence in the business. I enjoy the newest percentage of freshly added salable info inside the relation so you’re able to contracted conversion have a tendency to rather for the developers i rates. The 2025 conversion show commonly in turn suffer.