You required background information on individual financial insurance rates. You want to know the way it works, if it is required, at what area somebody is take it off, and you will what are the results that have PMI when financing is actually refinanced. Your asked that jurisdiction over it, whether or not Congress has taken any latest methods here, and you will what legislative choice all round Assembly keeps.

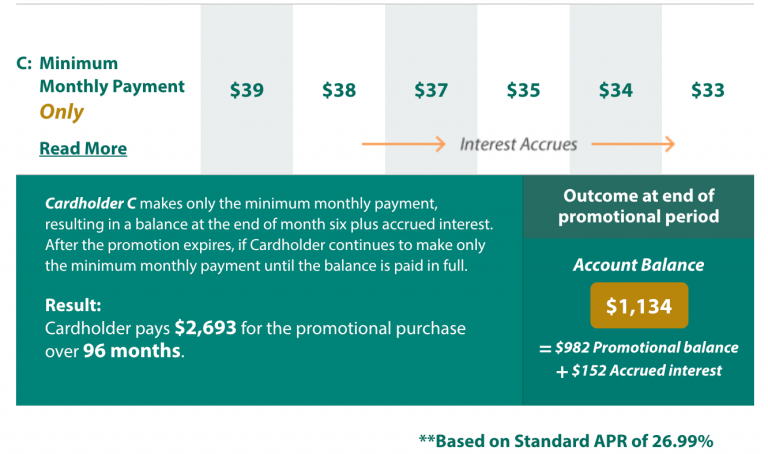

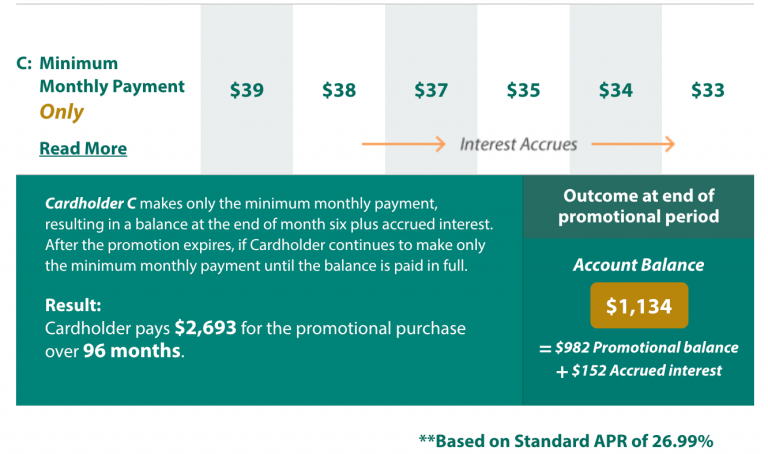

The borrower pays the brand new premiums. These can do the sort of just a single one-day superior otherwise a smaller right up-front side percentage from half the normal commission of amount borrowed combined which have monthly obligations put in the borrowed funds money. Without it insurance rates, loan providers usually require a 20% downpayment; with it, the newest borrower may have to put down just 10%, 5%, or less. Historically, if as well as just what top someone might get reduce PMI relied into the mortgage holder ‘ s regulations, except in certain claims having particular standards. Fannie mae and you will Freddie Mac enjoys enjoy termination when guarantee are at 20%. However it is as much as the new lender so you’re able to I rules.

PMI covers the major 20% of your own financing in situations where new borrower can make a smaller down payment

Connecticut rules already demands PMI enterprises becoming authorized by Insurance coverage Department and requirements loan providers to make certain disclosures towards prospective termination of insurance policies, however it does perhaps not set a certain date if the bank or mortgage holder needs to terminate the insurance coverage.

A unique government law, introduced from inside the I, with some exclusions. It will require impact July 31, 1999 and you will, for brand new mortgages then day, demands termination regarding PMI in the debtor ‘ s request when new collateral is located at, or is scheduled to reach, 20% should your borrower match specific standards. They further demands automatic cancellation of the insurance coverage if the equity reaches twenty-two% (good 78% loan-to-worth proportion) in case the debtor was latest to your his costs. What the law states consists of particular exceptions getting highest-risk mortgage loans, however, prohibits extension of one’s insurance coverage outside the midpoint of one’s amortization period regardless. In addition needs loan providers, starting in July 1999, to make specific disclosures telling this new debtor regarding his legal rights regarding the PMI, for both brand new funds and you may current financing.

The new government law grandfathers particular present condition legislation that will be maybe not inconsistent, such as for instance Connecticut ‘ s latest revelation criteria. In addition it offers claims with such secure condition laws a-two-seasons window and come up with limited changes that aren’t contradictory with this new government laws.

PMI protects the lending company towards a domestic mortgage of financial loss of situation the newest borrower non-payments towards the payments. It is entitled private mortgage insurance to tell apart it out of authorities promises. The newest borrower usually pays the fresh superior, however, increases the benefit of being able to purchase a house eventually or becoming able to buy a much bigger household than simply or even because a smaller sized downpayment needs. Rather than PMI, lenders constantly require a 20% deposit. Since most non-payments occur in the early many years of financing, once the proprietor ‘ s guarantee remains lowest, PMI lets the financial institution to make large-exposure loans than simply if you don’t.

Private financial insurance coverage (PMI) are plans ended up selling because of the a personal insurance carrier you to covers the financial institution towards a mortgage whether your debtor non-payments

This new debtor will pay an initial premium during the closure (commonly half of step 1% of loan amount) and you will monthly payments as well as the monthly mortgage repayment. Alternatively, he https://cashadvancecompass.com/payday-loans-de/houston/ may pay a one-date unmarried advanced. Premium will vary one of organizations. He or she is according to research by the quantity of the new advance payment, perhaps the loan is restricted-rate otherwise adjustable, if the premium was paid-in a lump sum payment or month-to-month, and you will if or not one area of the premiums was refundable.