Elderly Publisher

This information will get include user backlinks. Which means that we might earn a percentage if you make a purchase owing to the hyperlinks. Excite understand the revelation for more information.

After you make an application for home financing, the lender requires files to verify the application. New models needed to own home financing based your type of situation. For-instance, a self-operating person will need to fill out different forms than one employed by a strong.

Predicated on the money you owe, there are seven home loan data files that you could want add when making an application for a mortgage.

step 1. Tax statements

The borrowed funds lender wish to know the whole picture of debt position. They are going to probably require you to sign a questionnaire 4506-T. It allows the financial institution to consult a tax come back content of this new Internal revenue service.

Extremely loan providers wanted at least one or one or two years’ tax returns. These ensure that your yearly income is actually similar to the repayments you stated towards shell out stubs. And additionally, here shouldn’t be big yearly fluctuations

dos. Shell out Stubs, W-2s, or other Income Evidence

The lender will get demand brand new pay stubs you have acquired in the earlier few days. Tax returns provide them with an idea of your overall financial reputation, and you may shell out stubs can help to evaluate your money.

If you are worry about-employed or provides almost every other income sources, you might have to show the lender’s legitimacy via 10-99-variations, head deposit, or any other steps.

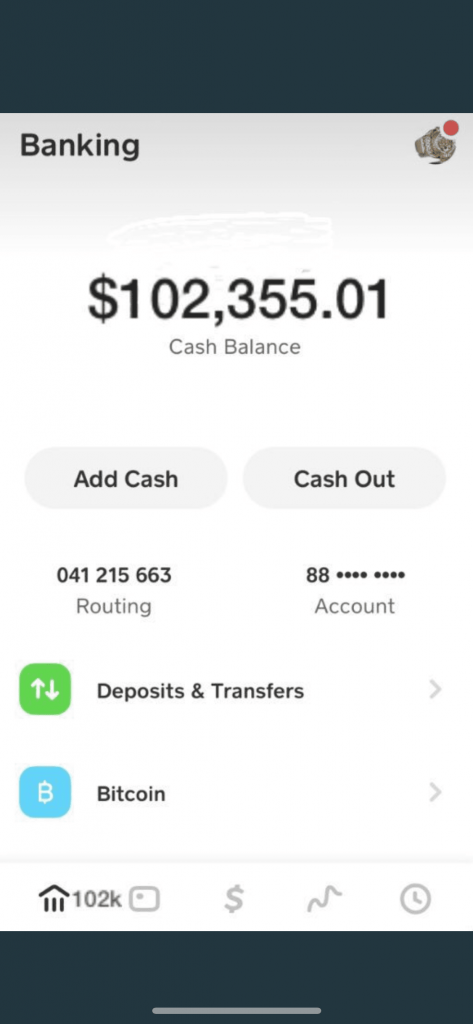

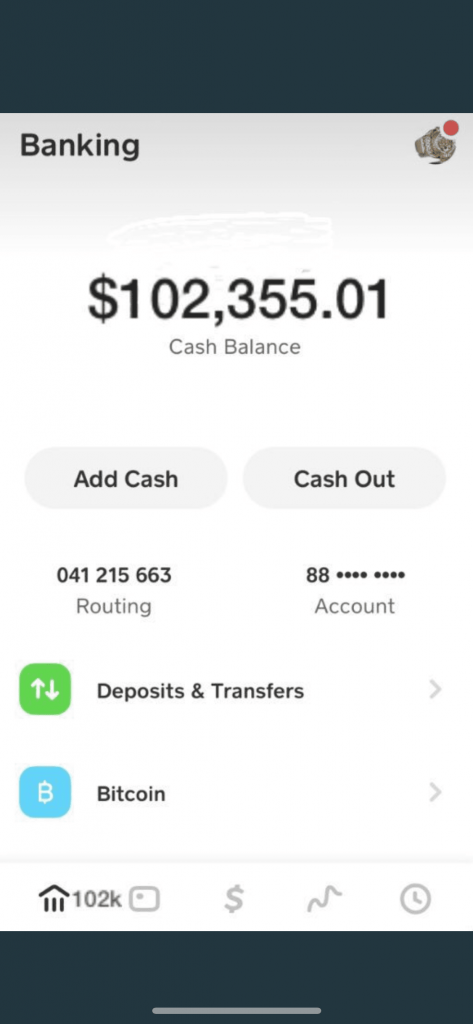

3. House and you can Lender Statements

While you are assessing your personal risk, the lenders might look at the bank account and other assets. This may were their expenditures and you can insurance rates, including insurance.

Lenders normally wanted such data files to make sure you provides a few months’ worth of home loan reserves on your own account in the the big event away from a crisis. They will also check if the advance payment was in your bank account for a few days and don’t appear at once.

cuatro. Credit rating

To check on your once the financing applicant, lenders can look up your credit rating along with your written or verbal consent. You might have to define any inconsistencies on your credit score.

It could be wise to had been willing to develop good declaration describing bad issues on your credit file. This will help the lender dictate the risk peak. The lending company get take a look at affairs that are inescapable getting a primary date in another way in the usual delinquency.

5. Provide Emails

Your friends and relations could possibly get help you in to find a home by providing your currency. If this sounds like your situation, you will have to technically concur that the money was a bona-fide provide and not a loan.

The latest data files should mention the relationship involving the individual who is gifting and you also, along with the genuine level of the brand new gift.

6. Photo ID

You will probably need expose an image ID, eg a license. It is just https://paydayloancolorado.net/lincoln-park/ to show that you will be who you allege to be.

7. Reputation for Renting

If you’re a purchaser whom doesn’t very own a property within present, many loan providers will need evidence as possible pay on time. They may consult a complete year’s worth of terminated rental cheques that your landlord provides cashed.

They could plus pose a question to your landlord to submit evidence you are making their lease costs with time. The rental history is particularly important if you don’t have an effective lengthy borrowing from the bank records.

Final Term

The necessary documents add the borrowed funds consult can be brand new exact same for all banking institutions or any other financing organizations. Specific specific conditions you may differ from bank to lender.

New records necessary for home financing may also differ mainly based in your financing bundle, the nature of the loan, the borrowing from the bank character, an such like. Having versatile money, it’s also possible to consider utilizing a mortgages credit partnership.

Aidan might have been speaing frankly about personal loans for over six ages. Prior to this, he spent some time working due to the fact a business Funds Expert where the guy specialized in Due diligence, Team Valuations and. He is good CFA charterholder.