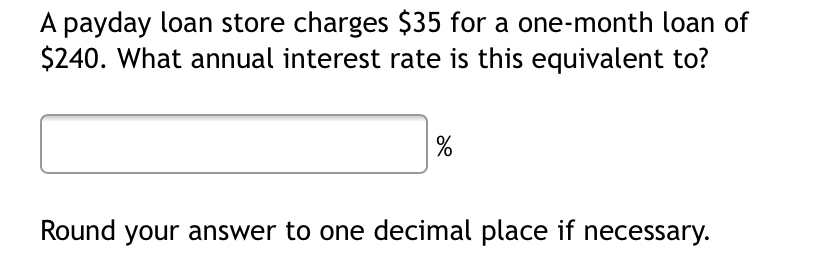

Meters ore than just a third (36%) out-of residents old over forty say that and make changes to their household otherwise lawn was their top priority in the old-age. But if you reach it milestone and the financing to help you finance home improvements commonly instantaneously readily available, try to think hard towards best way to help you loans renovations.

Whether you want to improve your kitchen area, generate a beneficial conservatory otherwise convert your own loft in order to make a supplementary bedroom, the price was steep. For example, a normal attic transformation costs ?step one,step one50-1,350 for each rectangular metre however it can truly add as much as 20 % to the home’s really worth.

It is smart to get prices from at least around three some other designers, once the costs are very different generally according to the particular conversion process. But before you will do actually one to, it’s wise to decide the best way to funds your residence advancements. They are four most well known implies:

- A lot more borrowing to your a home loan

- Starting guarantee

- Do it yourself financing

- Playing cards

- Do you know how you’ll loans household renovations? Look for when the collateral discharge could help unlock tax-totally free dollars from your own home – Was the fresh totally free calculator now.

step 1. Borrowing from the bank on home financing to possess renovations

When you find yourself to make high alter that need a bigger contribution, credit extra on your own mortgage is a sure way to raise financing getting home improvements. But not, remortgaging isn’t really always quick for earlier individuals, due to the fact loan providers like to see research that you will have a steady income once you retire. They may and agree in order to give more a smaller label, that can indicate high costs.

As with every mortgage borrowing, you will find a danger of repossession when you find yourself struggling to keep up this new repayments. You can also want to consider the extra cost with it thanks to the attention paid over almost any time period you were to extend your mortgage from the. For the majority, getting that it chance in later years, immediately if your money will fall, won’t be the right choice.

2. Security release for renovations

Instead of credit more towards the a mortgage to possess home improvements, more mature property owners is launch security from their property to pay for price of renovations. Which have a lives mortgage, brand new UK’s most widely used security discharge unit, you can release a portion of your own home’s worthy of as the a good tax-free dollars lump sum payment.

Instead of having monthly repayments, which have a life financial the mortgage and you will desire and this goes up over go loans in Kimberly out are usually paid off on the collateral launch seller only if new past homeowner dies otherwise goes into long-term proper care. Typically, this is exactly hit into business of the property.

In the event the attention move-right up issues you, you will also have possibilities that enable you to create volunteer costs to the financial, if or not which is to pay the eye month-to-month or even to reduce the fresh an excellent matter over time. Should you wish to avoid this type of costs, you certainly can do therefore at any time rather than penalty.

It is critical to keep in mind that because of the opening guarantee out of your house now you’ll slow down the count open to your own property afterwards. While eligible to mode-checked out gurus, after that opening collateral may also apply to you to definitely entitlement.

3. Home improvement financing

A home update loan may possibly not be your best option to have earlier consumers since this may cause these to sustain a loans inside old-age that requires repair. Think about how a lot of time attempt to pay back the brand new loan if you are considering this method.

In contrast, having security launch, while you are taking financing, it’s not necessary to make repayments. And additionally, all agreements of Equity Release Council-approved loan providers provides a zero-bad guarantee make sure, which means you will never are obligated to pay more the value of your residence. Since matter you borrowed isn’t really owed to have repayment if you don’t perish or enter permanent much time-term worry, an element of the concern is that establishing collateral will certainly reduce the benefits of your own estate through the years.

cuatro. Having fun with credit cards to fund renovations

Whenever you are simply to make slight alter towards the possessions, you can also decide on credit cards to fund will set you back.

Eg, you’re planning offer your home a brand new new getting because of the redecorating, that may prices many techniques from multiple so you’re able to plenty, with respect to the the amount of your own change.

When choosing a charge card, imagine opting for you to which have a lengthy 0% Annual percentage rate basic several months, because you you’ll pay off your debts before you could is actually recharged notice. Keep in mind we are not giving advice on the latest access to handmade cards, and should you sign up for that acceptance is likely to be at the mercy of debt circumstances and you will credit score.

Consider carefully your investment with your equity discharge spouse

If you decide you want the latest peace of mind out of watching the new renovations without the need to make instant money getting investment her or him, then collateral launch was a worthwhile said to you personally.

Likewise, since there is a choice to create voluntary payments into the amount borrowed whenever launching equity, this 1 could offer much more self-reliance than other streams.

And while its worth considering that the style of capital family improvements will reduce the worth of your own estate, by using the security released from your own home to make improvements was planning raise the well worth and you can mitigate the this impact.

So you can know your own equity launch choice, the newest Telegraph Media Category keeps hitched having award-profitable security discharge specialist Responsible Collateral Discharge. Utilizing the calculator, you can learn how much cash tax-totally free dollars you’re entitled to release. You can also discover a no cost help guide to guarantee launch of the post and you may email address, plus listen to from their friendly Information Party.

In control might also be in a position to respond to any questions that you have, together with publication you a zero-responsibility meeting which have a completely licensed agent.

By firmly taking currency from the property now, an existence home loan will reduce the value of your own house. An existence home loan may also connect with your own entitlement so you’re able to setting-checked-out experts, but an adviser can take you step-by-step through the fresh feeling of if your wanting to go-ahead.

The new Telegraph Security Launch Service is offered because of the In charge Collateral Launch. Responsible Collateral Release is an investments sorts of In control Life Minimal. Responsible Lifetime Restricted is authorised and controlled of the Financial Run Authority that will be entered to the Financial Attributes Check in ( under resource 610205. On condition that you choose to go ahead plus instance finishes tend to Responsible Lives Restricted charge a recommendation payment, already not exceeding ?step one,690.

The above mentioned article is made to possess Telegraph Financial Choices, a member of Telegraph News Category Limited. More resources for Telegraph Economic Choice, click on this link.