Navigating the road to locate recognized to have a house equity financing that have poor credit shall be difficult. The fresh RefiGuide has a network regarding household security lenders that provide poor credit HELOCs and you may guarantee finance for people with bad credit score.

Qualifying to possess a poor credit home collateral financing requires the candidate to obtain prepared and stick to a stronger package that includes money documents, letters away from factor having derogatory credit and you will an alliance with a home security financial institution which is willing to bring dangers if you’re approving security money if you have a bad credit records.

Such home equity loan choices can be way more available than conventional cash-out re-finance software nowadays with rising interest rates.

We believe that less than perfect credit home equity funds commonly you’ll in the present financing environment. This is simply not surprising that the people who tend to you desire financing more are those who do perhaps not be considered while they has actually lowest fico scores. If you have a minimal credit history, it is likely you was turned-down for personal funds or credit lines before.

Store Most useful Loan providers Providing House Security Funds and HELOCs for people with Poor credit Results.

Whether or not you would like fund to have studies, a medical emergency, an automible repair or restoring a leaking rooftop, you’re thinking how to faucet the brand new security in the your property to obtain the currency you desire.

If you really have got late costs, improved credit card debt or past credit problems, such as for instance a bankruptcy otherwise foreclosure, we commonly link your that have best-rated financial companies that promote repaired rates fund and you will home collateral personal lines of credit.

Compare House Security Finance and you will Lines of credit having An excellent, Fair and you will Bad credit Results

Even if you was indeed turned down having an earnings our very own refinance, you can even be eligible for a collateral mortgage with a less than perfect credit rating for those who have compensating facts.

Correspond with numerous loan providers prior to letting them remove the credit. For no prices to you, we’re going to assist you in finding brokers and financial institutions that provides household collateral finance that have less than perfect credit.

Here are a few a options to thought for those who have struggled to find a personal line of credit that have a reduced credit score;

Ways to get property Collateral Mortgage to have Poor credit

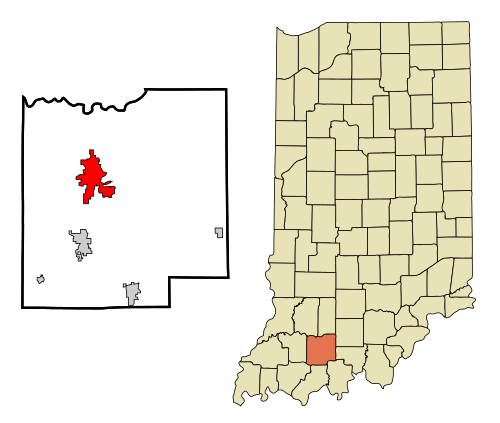

Property security mortgage is much like an effective HELOC nevertheless get the residence’s collateral loans Three Oaks up to a quantity from inside the an effective unmarried lump fee. When you yourself have an individual, higher expense you pay today, you can imagine a property collateral loan, such as a giant medical costs or the down-percentage from a property.

A property security mortgage keeps a fixed rate of interest and you can fixed monthly payment. Loans which have poor credit might have a high rate than best borrowing from the bank collateral loans, plus higher still if you have the lowest credit score, nonetheless it continues to be a good option for those who have poor credit but use of household collateral. This is simply not an ensured home collateral mortgage alternative but deserving of consideration nevertheless.

The RefiGuide will help you get a hold of loan providers and you may banks that provide a property equity mortgage having poor credit so you’re able to individuals which have compensating points. This isn’t protected home guarantee mortgage that have poor credit, but there is however the opportunity really worth examining.

A security financing which have bad credit offer numerous experts in the event it relates to debt consolidating. First of all, these types of security financing allow home owners in order to power the brand new guarantee they’ve dependent right up inside their possessions so you can safer fund at usually less desire costs compared to the other types regarding financial obligation, for example handmade cards otherwise personal loans.