Elderly House Lending Mentor

If or not you have receive just the right house or you happen to be just looking, looking at offered direction apps helps you form a strategy for shifting.

Fixed- Rates Mortgages: A predetermined-rate mortgage even offers a normal interest for as long as you’ve got the financing, rather than a speeds one to adjusts or floats towards the field. A normal interest rate results in your concept and focus percentage will stay uniform too.

Adjustable-speed Home loan (ARM): An arm mortgage has an interest speed one to stays an identical for a set time, upcoming changes in order to a changeable price you to definitely changes annually. Eg, an excellent seven/six Sleeve has actually an introductory interest on the basic eight ages following resets twice yearly next for the kept loan identity.

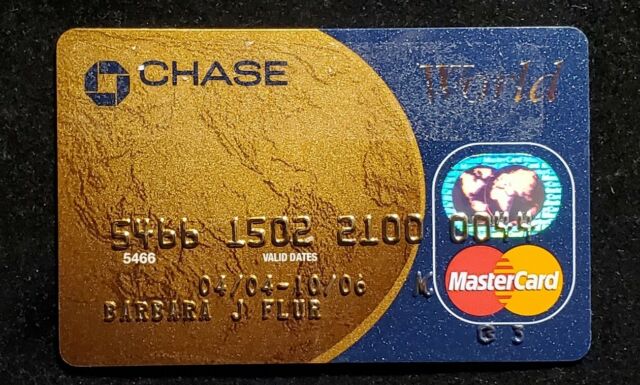

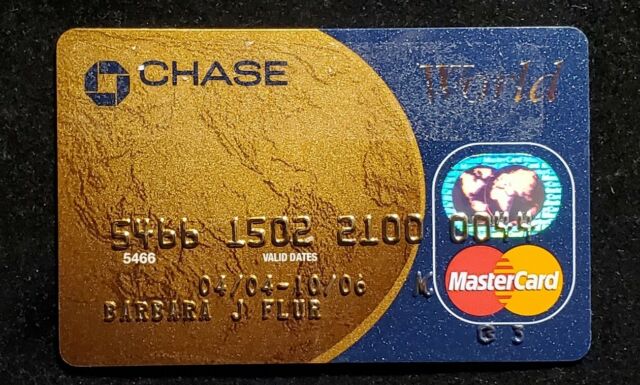

Kelly Martinez

Term Duration: The duration of the mortgage usually perception their payment. Such, this new reduced the mortgage term, the greater number of you’re likely to pay monthly. As you speak about alternatives, consider carefully your down-payment, the monthly funds and you can bundle accordingly.

Fixed- Speed Mortgage loans: When you find yourself fixed-rates funds render a reliable mortgage payment, they typically enjoys increased rate of interest. Because you weighing the options, you are able to ask yourself, “So is this my personal forever house, or simply just a place where I’ll real time for many age?” Which can help you know if a predetermined-rates financing suits you.

Adjustable-rates Mortgage: If you’re you will probably shell out a diminished interest rate inside the basic period, the fee you can expect to raise quite a bit when this period concludes-possibly a lot of money 30 days. Rate limits limit the count their interest can go up, however, make sure to understand what your restrict fee will be.

1. Products and calculators are offered since a complimentary in order to estimate your mortgage demands. Overall performance revealed try rates only. Talk to an effective Chase Household Credit Mentor for lots more certain recommendations. Message and you will study costs will get apply from the supplier.dos. To your Adjustable-Rates Home loan (ARM) tool, attention is restricted to own a-flat time, and you will adjusts from time to time afterwards. At the conclusion of the latest fixed-price months, the attention and you can costs can get improve based on future directory costs. The fresh Apr will get boost following the loan closes.3. Financing doing 85% from a beneficial residence’s worth arrive on the a buy or re-finance with no cash return, susceptible to property type, a necessary minimum credit rating and you will at least quantity of monthly reserves (we.age., you ought to reserved enough money in set aside to make good specified amount of month-to-month mortgage repayments dominating, attention, taxation, insurance coverage and assessments pursuing the financing closes). Unit constraints pertain. Jumbo loans readily available up to $nine.5 mil. To have mortgage quantity greater than $3MM (or $2MM to have financial support services), customers need satisfy article-closing advantage standards to help you be considered. Even more limits could possibly get apply. Excite contact good Chase Family Lending Mentor to own information.4. The brand new DreaMaker home loan is just available for purchase with no-cash-out refinance out-of a first quarters step 1-4 tool property for 29-year repaired-speed terms. Income restrictions and you can homebuyer degree direction is required whenever all mortgage people try first-time homebuyers.5. FHA fund need a right up-front side home loan premium (UFMIP), that can be financed, otherwise reduced at closing, and you can an FHA annual mortgage advanced (MIP) repaid monthly might use.6. Pros, Services players, and members of the National Guard or Put aside may loans Saddle Ridge CO be eligible for a loan secured from the You.S. Service out of Veteran Facts (VA). A certificate away from Qualification (COE) throughout the Va is required to document qualification. Constraints and you will restrictions apply.seven. An effective preapproval is dependant on a peek at money and you may investment pointers your render, your credit report and you can an automatic underwriting program review. The issuance off a good preapproval page isnt financing commitment or a vow having loan acceptance. We may offer a loan relationship once you submit an application so we perform a final underwriting comment, also confirmation of every suggestions given, possessions valuation and you can, in the event that relevant, investor acceptance, which may end in a change to the fresh new regards to your preapproval. Preapprovals aren’t available on the products and get end once ninety days. Get in touch with a house Lending Mentor getting information.

The latest NMLS ID is a special personality number which is approved from the Nationwide Mortgage Certification System and you can Registry (NMLS) every single Real estate loan Inventor (MLO)

JPMorgan Chase cannot render tax pointers. Delight consult your taxation coach towards deductibility of great interest and you may other costs.