In terms of the brand new tips working in to get a home, arguably the most important (and first!) you to you ought to grab is getting accepted to have a home loan. There are a number of things your home loan company will envision when deciding simply how much house you really can afford, one are your debt-to-earnings proportion. Here is what you need to know with respect to deciding exactly how the debt make a difference to what you can do to obtain a home loan toward property.

What is a debt-to-income proportion?

Your own financial will perform an easy computation, taking into account your monthly expenses plus month-to-month earnings source, which will show the debt fee. Which proportion shows an image of your financial stamina and suppresses you from to get property that you could never be able manage. Exactly what affairs get into the debt-to-income proportion? Basically, the low your debt as well as the large your income, the greater number of you are recognized for. Quite often, a lender need your overall financial obligation-to-income ratio getting 43% otherwise faster, making it crucial that you be sure you fulfill so it standard under control in order to be eligible for a mortgage. There’s also a construction proportion one to lenders evaluate, that is less than the DTI proportion. Houses ratio ‘s the the latest suggested percentage, taxes, insurance policies, HOA, an such like. in place of revenues. Loan providers want it to be up to 29% or quicker, typically out of thumb.

Just like the loans-to-earnings ratios are determined having fun with revenues, the pre-taxation number, it is better is old-fashioned when determining what size regarding a home loan you then become safe trying out. Your ount can get suggest way of living salary-to-salary as opposed to to be able to rescue some of your earnings every month. And don’t forget, if you’re during the a high money group, the new part of the net income you to goes toward taxes will get feel highest.

If you find yourself your debt-to-income ratio is determined with your revenues, envision basing their computations on your net gain getting a great a great deal more practical look at your finances and you will what matter you would certainly be safe paying for a house.

Self-a career can impact your debt-to-earnings proportion

Self-a job is typically desired-immediately after towards autonomy it offers therefore the capacity to really works out-of wherever you decide on. Normally, a type 1099 can come toward play if you have complete independent performs (particularly good freelancer). You use the 1099s to declaration gross earnings, up coming cause for any deductions, costs, write-offs, etc. to determine the bottom line profit or loss. The brand new loss or profit is what the lender discusses, and the 1099s will be the help records that is needed . To ensure that yourself-a position income become included:

You will have to reveal feel in your providers, because the severe refuses otherwise transform about early in the day season in terms of cash you will prove challenging whenever qualifying to possess a home loan.

Such as for example, i recently purchased a property, incase going through the financing process, my bank computed my income earned regarding notice-a position did not be used whenever figuring our debt-to-earnings proportion just like the I did not yet , keeps several complete years of consistent money. That it appeared since an enormous treat for me, however, once i talked using my financial, We realized the necessity of income balance.

Their student loan financial obligation matters

Into the millennial age bracket, stuck having education loan financial obligation and more than 50 % of being unsure of how much time it will require in order to become debt-100 % free, getting home financing might be a great trickier process. This is because their student loan financial obligation are factored into your debt-to-earnings ratio. Particularly, home loans insured by Government Homes Management in reality requires their education loan personal debt to-be evaluated one of two implies: The bank need play with:

The more away from: 1 percent of the a great scholar obligations equilibrium can be utilized if not see the forecast payment, or the payment per month while the said on the credit history

Though their loans are presently during the deferment, they’ll certainly be counted in your loans-to-money proportion. Very, perhaps you have realized, your own student education loans can have a large influence on your capability so you can borrow money buying a home. For each program may differ, therefore don’t forget to consult with your lender in the student loan guidelines.

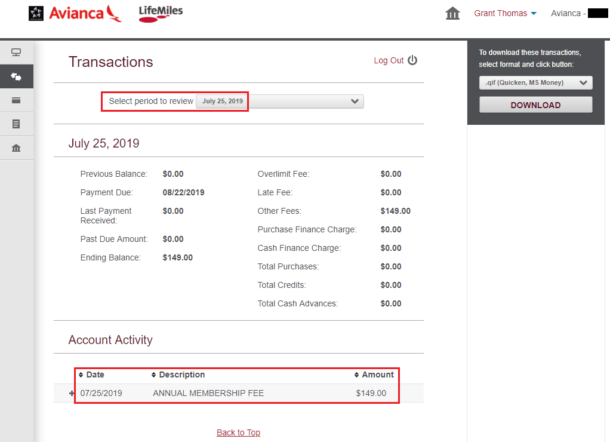

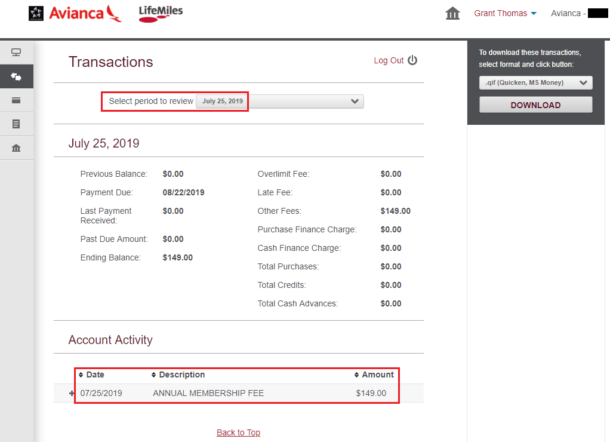

Scientists learned that over 38% of American homes carry at the least some sort of mastercard debt. If you are one of these some body, you should know of one’s effects it may enjoys with the the debt-to-income proportion. Their mastercard monthly minimum repayments are factored in the personal debt-to-money proportion, thus looking after your balances lower might be important whenever obtaining home financing. Aside from, your credit worthiness falls under the borrowed funds app techniques, so it is also essential and make the monthly premiums timely and reduce amount of credit concerns on the label for the purchase to keep up a wholesome credit history.

Tips alter your loans-to-money ratio

Whenever you are looking to purchase property, it’s a good idea to help you estimate your debt-to-money proportion within the think processes. This should help you know if you have the 43% or shorter financial obligation-to-income ratio you to a majority of loan providers need. If you find your loans is simply too large, it could be a smart idea to begin tackling a number of those stability otherwise trying to find a lot more earnings provide in order to have a knowledgeable likelihood of being qualified having a home loan. Here are a few how to get been:

Fool around with playing cards modestly. The only method to reduce your month-to-month expenses is to try to pay down your debt, so if you continue to use the playing cards and bring an equilibrium, you will not have the ability to decrease your month-to-month expenditures.

Continue perfect facts of the worry about-employment income. Even though you could have no less than a couple of years away from care about-employment using your belt, without having the necessary income tax information to back up https://paydayloancolorado.net/lazear/ your revenue earned, it may be difficult to obtain home financing.

Stop taking out fully most other money. Knowing purchasing a home is on new vista, very carefully imagine the method that you invest your bank account. It may not be the ideal for you personally to purchase another type of vehicle or take out financing for an alternate band, as these might be factored to your debt-to-earnings ratio.

Unlock a savings account. Begin preserving today, and those dollars begins adding up! Placing extreme advance payment towards the a home will reduce the fresh new matter you will want to acquire, and therefore an inferior mortgage repayment and you may a lesser obligations-to-earnings proportion.

While the home loan procedure would be difficult, understanding the some other requirements makes it possible to prepare yourself beforehand, very you should have a greater chance of being qualified getting an effective brand new home. When you’re happy to make the step into the homeownership, contact a home loan banker today.