Having aggressive rates with the household guarantee loans and HELOCs, that it bank may be worth a glimpse — if you live close a part.

Situated in Chi town, he writes with you to definitely mission planned: Let customers figure out how to rescue many be concerned less. He is and additionally an artist, which means he’s spent long worrying about money. He can be applied the brand new courses he’s read regarding you to financial controlling act supply practical advice about individual purchasing behavior.

TD Lender is one of the ten biggest banking institutions from the United states, giving just about every economic tool — credit cards, examining membership, Cds, mortgage loans, domestic equity funds and you can domestic guarantee lines of credit and — in order to nearly 10 billion users. The financial institution was headquartered during the Cherry Slope, Nj, and you will works over 1,100 branches in the Northeast, Mid-atlantic, the brand new Carolinas and you will Florida.

TD Bank: Instantly

Closure property equity financing that have TD Financial need their when you look at the-person presence; it can’t be done on the internet. That being said, TD Financial is most effective to help you consumers who live close you to of your own bank’s 1,100-plus branches along the East Coastline.

When you make use of your house security that have a mortgage from TD Bank, evaluate these big pros and cons.

Everything we like

- Fixed-rates self-reliance: There is the solution to transfer a portion of your own HELOC to a fixed-rate loan.

- On any type of kind of household: You can borrow against guarantee towards number 1 and you will 2nd houses and you will financial support features.

- Extra savings to own current customers: You could potentially reduce your interest because of the 0.25% if you are using autopay that have an effective TD examining or bank account.

That which we can’t stand

- Additional can cost you: $99 origination commission into the each other things, also an excellent $50 annual commission towards the HELOCs.

- In-people closings: You’ll have to visit an actual physical bank department to shut a property collateral loan or an effective HELOC which have TD Financial.

- Challenging tiered rate program: TD Bank’s rates trust a range of items and additionally exactly how far your acquire, how long you’re taking to expend it back and property particular.

House security loan selection

Domestic equity credit line: TD’s HELOC choice demands the absolute minimum amount of $twenty-five,100, even if it is possible to only pay for just what make use of. In the first a decade, you could draw down the number and you can decide to pay only the attention charge. Next, you should have a great 20-seasons repayment several months. TD does offer the choice to convert to about three portions of one’s money into the fixed-rate financing, fundamentally securing in your interest to end spending large charge. Extent transformed into a fixed speed have to be at least $5,100000. You can easily spend a $50 annual fee into the a great HELOC during the TD Lender, or you can will waive the price tag having increased interest.

House collateral financing: TD’s repaired-rates home collateral fund need a minimum amount of $10,100000. You’re going to get the money in a single lump sum personal loans with bad credit and no income verification Denver North Carolina payment, and you can prefer to pay it off from inside the four, ten, 15, 20 or three decades.

Having each of TD’s family collateral products, prices differ in accordance with the amount you will be borrowing from the bank and also the style of from assets. Each other come having an excellent $99 origination percentage — a familiar fee expected to initiate a new application for the loan.

TD costs good $99 origination payment on its domestic collateral lines of credit and you may house equity finance. HELOCs feature a good $50 annual fee, even though you is waive new yearly commission in exchange for good high Annual percentage rate.

There are many more can cost you to adopt, plus an assessment to confirm the house’s worthy of and you will subordination and tape charges. If you want to lower your HELOC, it is $35. Whenever you have to pay new HELOC from early, you will have to pay an early on cancellation payment, and is around $450.

How to meet the requirements

When you’re TD Financial cannot in public checklist the credit history criteria on the internet, the newest bank’s custom rate-coordinating tool implies that borrowers will require at the very least a good 660 credit rating. On the other hand, your shared financing-to-really worth ratio with your newest home loan don’t surpass %. For example, in case the property is really worth $eight hundred,000, their overall the fresh new financial obligation has to be less than $359,960.

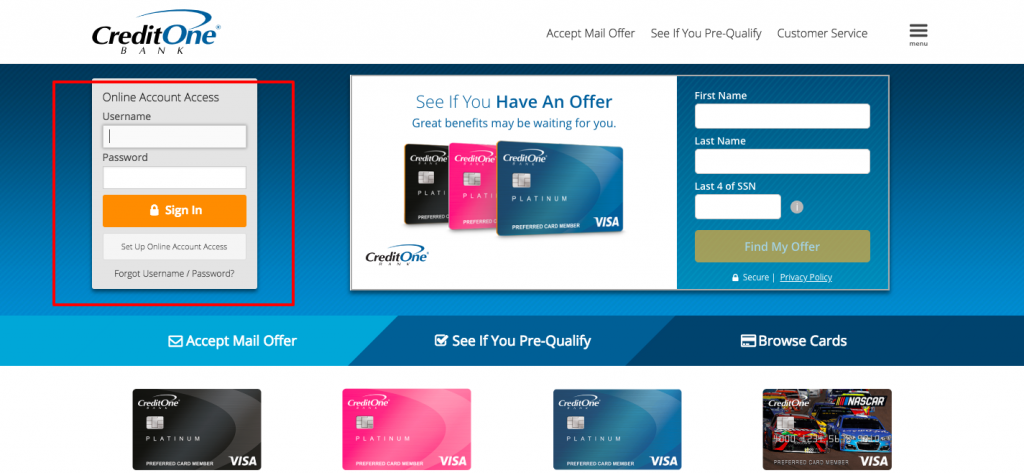

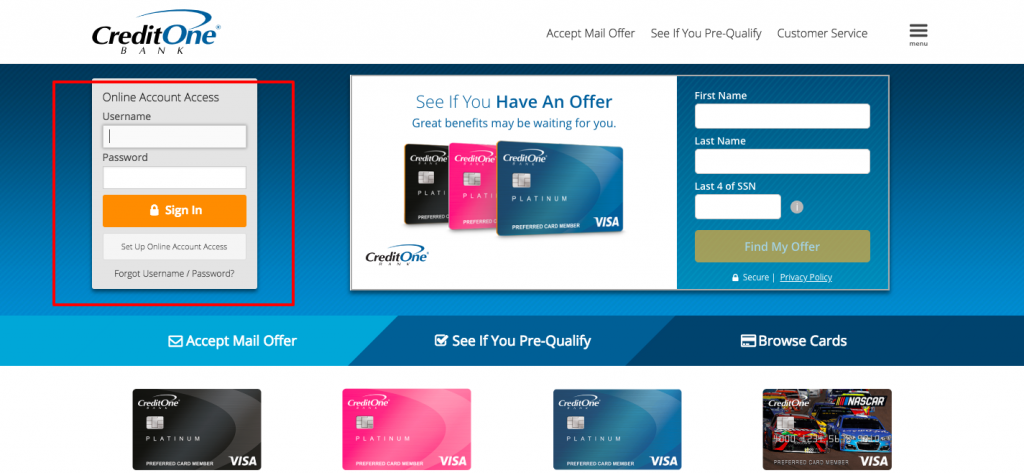

Starting out

There are plenty of how to get the application become: on line, phone or even in-people from the a TD Bank branch. How to guess the words so you’re able to compare with almost every other lenders without difficulty is with the fresh bank’s customized speed product. Provide several pieces of analysis about your value of, a good obligations, credit rating and you will possessions types of, in addition to calculator have a tendency to display screen a variety of selection which have month-to-month percentage terms and conditions.

For many who 1st meet TD’s standards, that loan mentor often get in touch with one to enable you to determine if you will want to plan an appraisal with an inside assessment. Then, you can easily move into the full underwriting procedure, that has a comprehensive report on your finances to confirm you to you can spend the money for loan straight back. When it’s ultimately for you personally to intimate, possible sign all your data files privately from the a great TD department.

Support service

You could come to an excellent TD Financial house security credit specialist by the contacting 800-815-6849. The financial institution has the benefit of customers assistance via head message for the Fb and you may Twitter Live messenger, though its uncertain whenever these types of streams is actually unlock for communications. If you prefer in-person recommendations, utilize the bank’s website to get a hold of a department near you. Remember that instances differ by location.