Credit or Credit ratings include 300 so you’re able to 850. A high number indicates all the way down risk. Whenever applying for home financing, any score more than 740 might possibly be qualified to receive a low possible rates to the a certain mortgage. Another dos situations play with 670 on reasonable FICO score and 740 to the high get.

The brand new Number

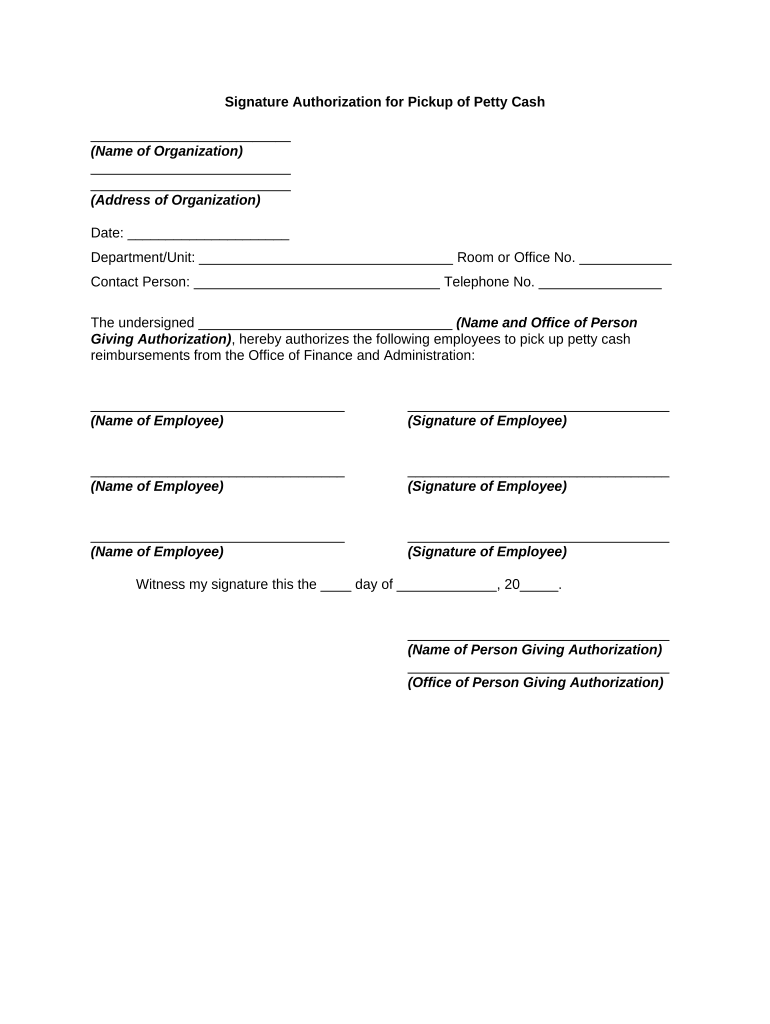

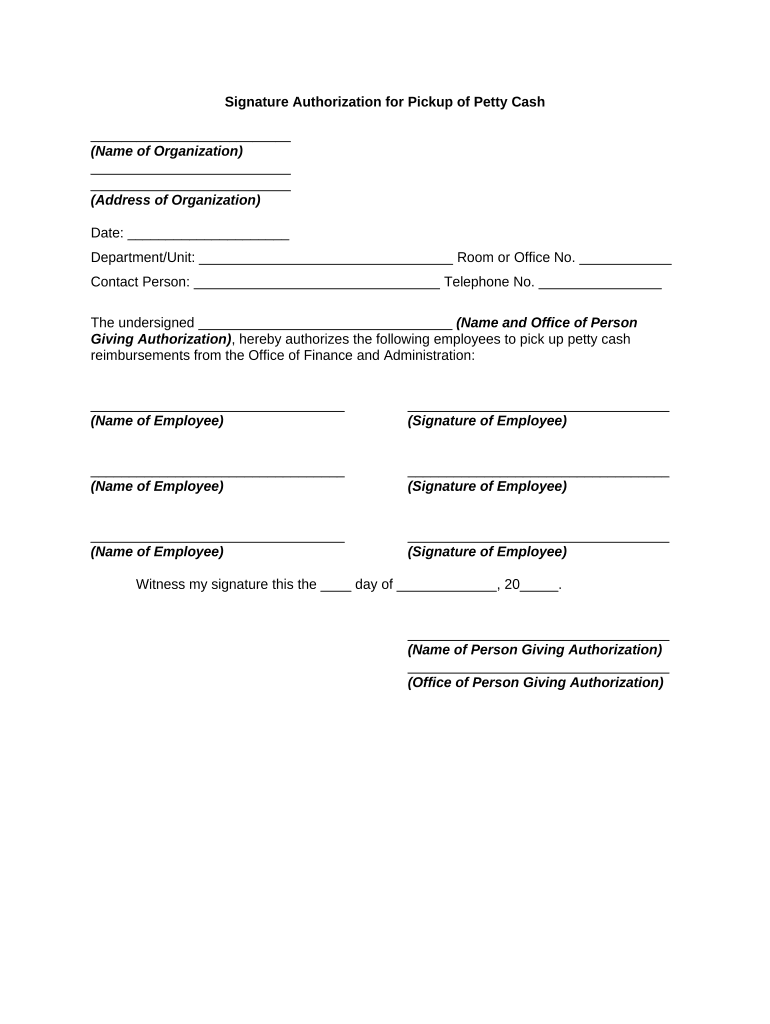

Contained in this circumstance, the interest rate into the a 30-seasons repaired rate financial with the expert buyer (740+ FICO get) was 5.000% (5.173% APR) that have a payment out of $dos,494 (excluding fees & insurance). The buyer that have fair/a good credit score (670 FICO score) on a single kind of mortgage is eligible getting a speeds out-of 6.500% (seven.016% APR) which have a payment per month from $step three,103. One to commission are $609 a great deal more each month, totaling $eight,308 per 12 months the consumer is actually that loan. Not just ‘s the all the way down FICO rating expenses more from inside the focus (six.5% versus 5.0%), also they are expenses a lot more in private Financial Insurance rates ($259/mo compared to $79/mo). Individual Home loan Insurance policies (PMI) is required because of the extremely loan providers whenever getting less than 20% deposit. Comprehend the graph below to possess an overview of the brand new fee distinctions.

What can be done

It’s easy to observe how far enhancing your credit can save when buying a home. It will likewise help you save for the almost every other personal lines of credit and credit cards and you may auto loans. It can even effect your house and you may automobile insurance pricing. But what do you really do in order to change your credit score to own now.

Listed below are 5 tips to help boost your credit history:

- Build your payments punctually. This is basically the essential issue. They makes up about thirty five% of your own get.

- Its ok to utilize credit cards however, carrying a high equilibrium (stability over 30% of your restriction, and particularly next to your restriction credit limit) can have an awful influence on your rating. The level of borrowing you use elitecashadvance.com/installment-loans-pa/kingston is 30% of score. E5 Lenders possess units to evaluate your own lines of credit and you can determine how much the rating can increase by paying along the harmony towards the particular cards instead of anybody else.

- Did we talk about making your payments punctually? Especially, you shouldn’t be late for a lease or mortgage repayment. Most lenders render an effective 15-date grace months instead punishment. Immediately following fifteen-months, you will be believed late and may getting charged a later part of the fee. Immediately after 31-days, you are sensed late and will boost the negative feeling to help you your credit score.

- Without having one playing cards, it could be worth getting one. Only build a fee and pay it off at the bottom of your month. That it shows what you can do to spend punctually. (select #step one and you will #3)

- Keep in mind the amount of profile. If you have numerous handmade cards, you don’t need to close all of them. Carrying a zero equilibrium will not harm, and then have a mix of readily available credit helps. not, inquiring from the and you may starting a lot of brand new outlines is harm credit ratings for a while.

The past word of advice should be to consult with E5 Home Financing prior to in search of another type of household or refinancing. Not only can one of the educated mortgage officials advice about an excellent prequalification and you will a speed quote, capable including inform you specific strategies to replace your individual borrowing from the bank condition.

When you yourself have any questions regarding looking at your borrowing from the bank or are interested observe what you are able qualify so you’re able to obtain, contact E5 Lenders. Even although you have a quote or prequalification, get in touch with you getting another Advice. E5 Lenders stores to find the best factors round the of several lenders therefore we don’t costs a bunch of in love fees.