Choice step 3: Transfer to your house

If your house is in your members of the family along with fond thoughts in the they, or you will be currently renting and able to getting a citizen, it might be a no-brainer to visit which channel.

So if you’re inheriting a property that is repaid, you might not need to bother about and come up with any extra monthly premiums, and that is a comfort – particularly if you arrived to the latest inheritance quickly.

Staying the house you’ll imply you’re qualified to receive a capital progress exemption as much as $250,000 from the money given that one filer or doing $500,000 for individuals who document a combined get back with your lover, provided your satisfy two conditions:

- The house is used as your first quarters for at least a few from five years.

- About 2 years preceding the fresh new sale of the house, you’ve not used the funding increases exclusion on a unique assets.

But not, if there is still a fantastic mortgage harmony on the domestic, you need to work with particular quantity to determine whether it makes sense to look at that financial burden. Sometimes, as mentioned above, the bill with the home loan may go beyond new home’s worthy of, the expenses off repairs and you will taxes are unaffordable for you, or dominant and you can notice (P&I) you’ll only be too much to handle. Whilst it seems like the simplest decision, we should guarantee that you’re not getting back in more than your direct before taking control of the home.

Let us recap; If you have recently passed on a property, here you will find the basic anything you need to take a look at from their number:

If you are not really the only Heir….

You can find issues the place you might not be the fresh just heir in order to inherit the house, and it is in fact very popular having family having multiple people to get the sisters as one inherit the property. Every so often, it will be simple enough to get to a shared arrangement towards the whether or not to offer otherwise book the home, however, different characters as well as other priorities can clash with regards to in order to deciding the best way to go.

You might have the option to invest in out the most other heirs by paying all of them bucks because of their show and achieving them signal brand new action out to your, but it is crucial that you note that this might imply a much bigger mortgage repayment about how to deal with thus. You additionally may need to spend settlement costs into the family along with an appraisal to search for the residence’s worthy of.

If you have recently passed down a house or expect you’ll on upcoming, consider using the fresh collateral you’ve gathered on your own number 1 assets to track down cash loans Laporte CO to possess repairs otherwise home improvements, or even to help handle the expense with the household.

Tap into their equity with no monthly installments. See if your prequalify getting an effective Hometap money in less than half a minute.

You have to know

We would our best to make certain all the information when you look at the this article is because precise that you could by the new time it is typed, however, one thing changes quickly either. Hometap cannot recommend or monitor people linked other sites. Personal issues disagree, therefore check with your individual fund, income tax or law firm to determine what is reasonable to you personally.

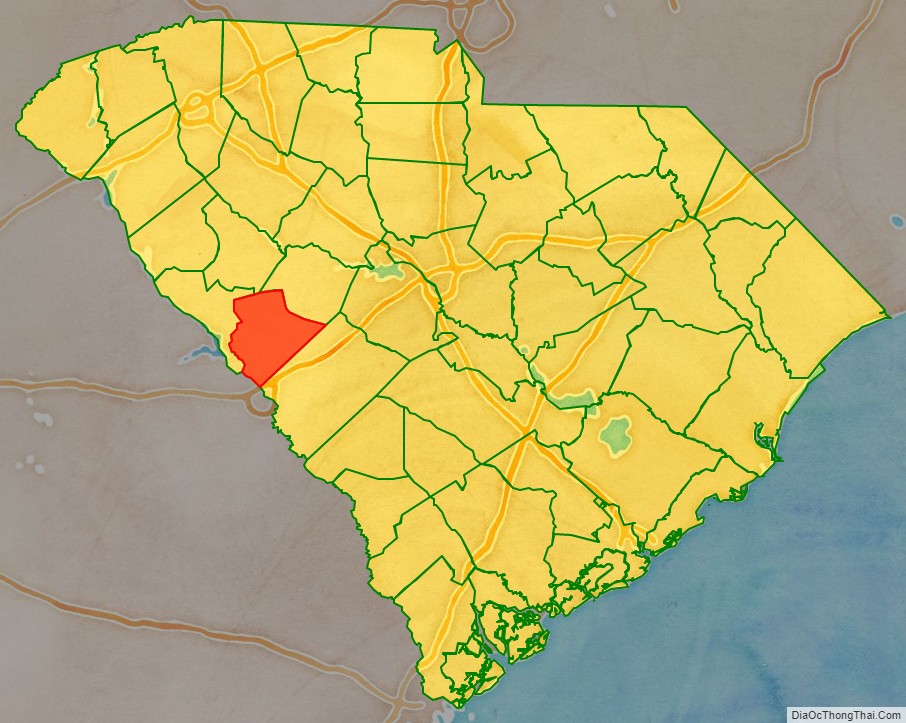

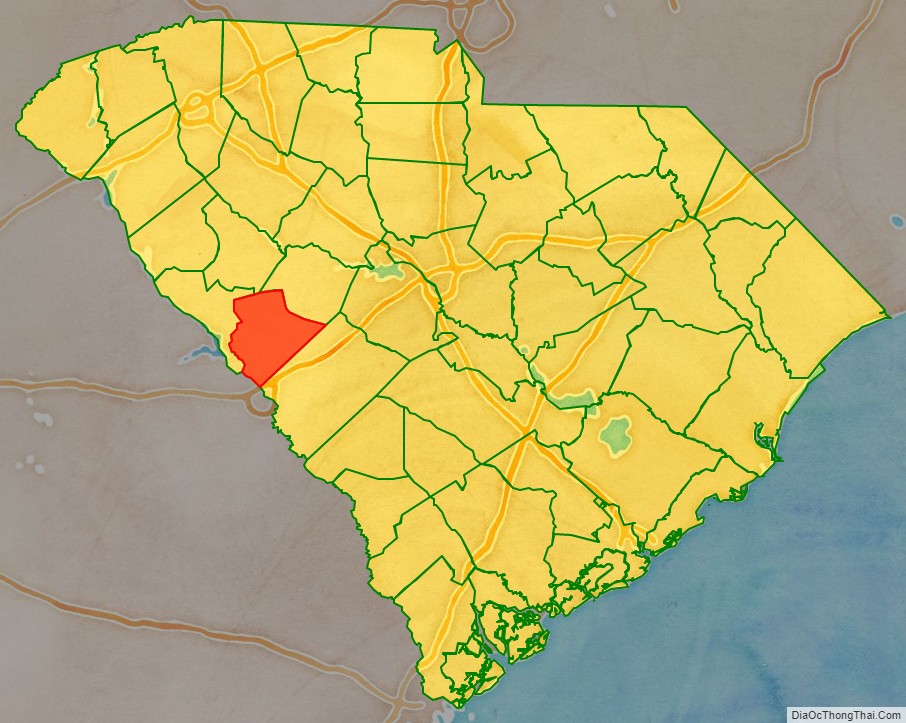

2022 Home Income tax by County

For those who go so it channel, additionally there is the chance that the house may require renovations in advance of it’s possible to lease it – therefore, same as if you find yourself creating improvements prior to selling, it can be beneficial to research financing options to find the most readily useful fit for the money you owe.