Chase Lender Financial Calculator in the united states into the 2024. Just how to estimate home financing oneself? Just how to work on home financing calculator? Financial pricing. What can I find away having fun with a home loan calculator? Home financing calculator on the U.S. are a hack familiar with help prospective homebuyers estimate the monthly mortgage payments. That it calculator takes into account the level of the loan, along the mortgage identity, the speed, and you may any extra costs or circumstances associated with loan. The fresh calculator after that supplies an estimate of your own payment number and you may overall financing costs.

Home loan Also provides out of

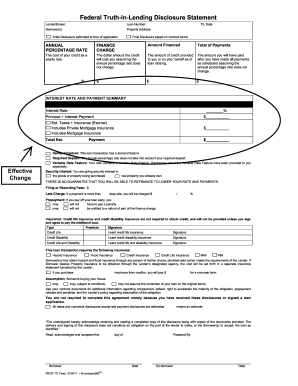

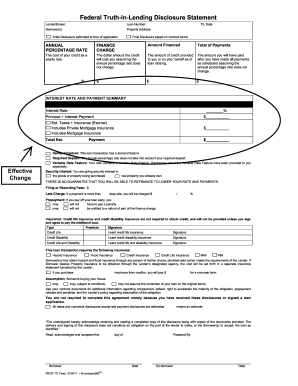

Before you apply to possess home financing, estimate the new monthly premiums. It will help that definitely are able the fresh financial. We wishing a handy financial calculator suitable for extremely purposes: insurance premiums to income tax write-offs.

Browse the home loan now offers regarding Chase Financial for sale in brand new U.S. inside the . The machine commonly match you into most readily useful has the benefit of for your demands depending on the computations you make.

To evaluate the opportunity of their mortgage application being approved, look at the credit rating on the all of our site. It is 100 % free. Thought one to finance companies agree mortgage people having a credit score of Banks loans more than 620. In the event the credit history is gloomier, we shall suggest a mortgage broker you could incorporate with.

Home financing is a big economic share, and that means you need to ensure things are under control. Check your credit history free-of-charge to ensure that you carry out not have a good expense. Financial institutions would-be unwilling to approve the financial software when the the debt-to-income ratio was lower. So, if you see unpaid debts in your credit file, safety them before you apply.

If your credit rating exceeds 620 and you have a decreased debt-to-earnings proportion, you could begin the program techniques. So you’re able to fill out the loan app, you could go directly to the bank’s site by the clicking the brand new Apply option otherwise using the financial application.

The financial institution commonly comment your credit report and cash lending chance. Adopting the credit score assessment and you will paperwork comment, the financial institution usually notify you of one’s decision.

Once their home loan software is recognized, you could begin finding a home. You are able to the features to track down suitable a house otherwise stick to the offers have located.

Pursue Lender Financial Calculator out-of

When you get the a home and finish the assessment, you might indication the loan loan agreement. The lending company usually disburse financing toward checking account or perhaps the seller’s membership. The newest solicitor tend to register the home transfer during the Residential property Registry.

Choosing among different kinds of mortgage loans is not that complicated if you will do your research thoroughly. Inside videos, i talk about part of the financial solutions: conventional mortgage loans, FHA, Virtual assistant, repaired rate, variable rate mortgage loans, jumbo finance, although some

If you opt to sign up for an interest rate, we recommend you take a look at stuff inside area. Which lowest level of information can help you fit everything in correct.

If you’re considering to purchase a property, you will need to work out how far you afford to acquire to possess a mortgage. Extent you could potentially acquire relies on your income, your credit rating, their advance payment, or other affairs. So you’re able to determine how far you can afford having Pursue Bank, you are able to a home loan calculator.

- Imagine the payment. A home loan calculator can help you imagine your payment founded for the number we want to use, the interest rate, and financing name. This can help you bundle your finances to see exactly how much you can afford to invest into a property.