With respect to protecting a home loan, Regions Home loan stands out as a reliable and customer-centered bank. Whether you’re a first-time homebuyer, trying to refinance, or looking to other a home loan selection, Countries Lender also provides a variety of home loan options designed to match your position. On this page, we will take you step-by-step through everything you need to know about Nations Home loan, out-of mortgage versions and you may positive points to the application form techniques.

step 1. Fixed-Rates Mortgage loans

Perhaps one of the most popular selection from the Places Mortgage ‘s the fixed-speed financial. Once the term implies, this financing sort of now offers a consistent rate of interest on the financing identity, making it a nice-looking choice for homebuyers selecting balances. Fixed-price mortgage loans can be found in individuals words, typically fifteen, 20, or three decades.

Going for a fixed-price financial off Countries Bank means that your monthly obligations remain a comparable, providing monetary predictability along the lasting.

dos. Adjustable-Price Mortgage loans (ARMs)

When you’re offered to a far more versatile rate of interest that may start lower however, to alter over the years, Nations Mortgage now offers variable-rates mortgages (ARMs). An arm generally starts with a reduced interest rate than simply a fixed-rate mortgage, however it adjusts periodically considering business criteria. This is a good option for homeowners exactly who propose to offer otherwise re-finance until the adjustable period initiate.

step 3. FHA Financing

To possess borrowers whom may not have a huge down payment or a top credit history, Regions Bank has the benefit of FHA funds. Supported by brand new Federal Casing Government, FHA loans are perfect for basic-big date homeowners and those with limited savings. Countries Mortgage makes it much simpler to own licensed customers to get to homeownership through providing lower down commission criteria and a lot more lenient credit history guidelines.

4. Va Money

Pros, effective military employees, as well as their family can benefit out-of Regions Mortgage’s Virtual assistant money. Such finance, supported by the You.S. Institution out-of Pros Items, provide advantageous terms and conditions such as for instance zero deposit, zero personal financial insurance (PMI), and you can aggressive rates. Places Lender is actually dedicated to helping experts with lenders one to prize their services.

5. USDA Loans

For those looking to buy a property for the rural otherwise suburban elements, Nations Home loan provides USDA fund. Such money, backed by the U.S. Institution away from Agriculture, include zero advance payment specifications and supply competitive rates of interest. Nations Financial makes it possible to determine if your qualify for this sort of mortgage, which is designed to promote homeownership in the less densely populated parts.

6. Jumbo Fund

If you are looking to finance a top-cost family, Places Mortgage has the benefit of jumbo money. These funds are available for characteristics one go beyond compliant financing restrictions put because of the Federal Property Fund Agencies (FHFA). When you are jumbo loans generally speaking include more strict borrowing and you can income conditions, Places Bank can also be assist you from the strategy to make sure your contain the investment need.

Advantages of Opting for Places Mortgage

When you favor Countries Home loan, we provide many different benefits that serve your own particular a home loan means. Check out reason why homeowners like Countries Bank getting their mortgage:

1petitive Interest rates

Regions Home loan also offers aggressive interest levels, whether you’re trying to get a predetermined-rates, adjustable-rates, otherwise bodies-recognized financing. The rates are designed to help you save money across the lifetime of the borrowed funds.

dos. Flexible Mortgage Choice

That have numerous home loan items, in addition to FHA, Va, USDA, and you may jumbo fund, Places Lender means discover a home loan choice for just about every borrower. The various loan brands form there are a mortgage one aligns together with your financial predicament and you will wants.

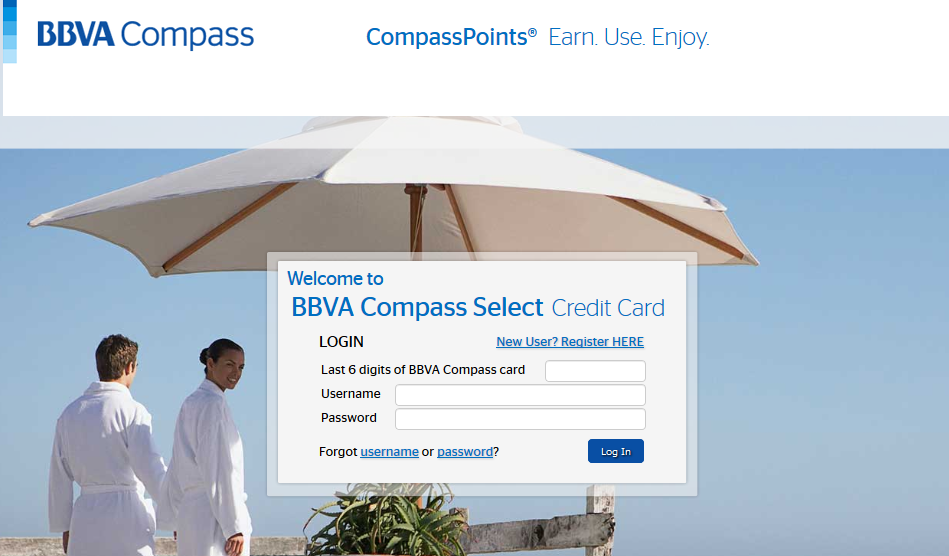

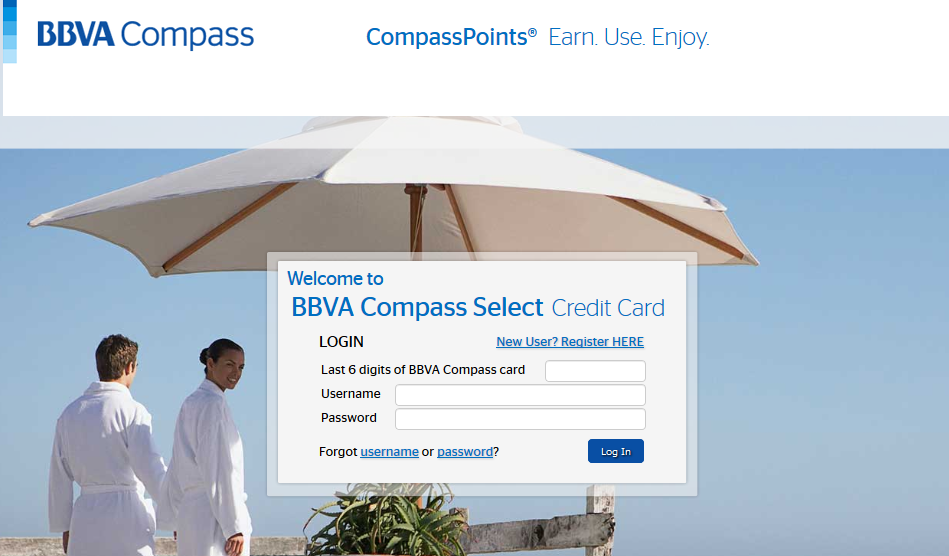

step 3. Effortless On the web Application Procedure

Places Mortgage even offers an easy-to-browse on line app procedure, enabling consumers to apply for a mortgage straight from their house. Out-of pre-qualification to latest approval, the web based webpage goes step-by-step, making the processes since easy and you will transparent that one can.

cuatro. Professional Information

Among standout top features of Nations Home loan ‘s the custom assistance provided with their mortgage advantages. If or not you may have questions relating to the borrowed funds processes, you need suggestions about and that home loan suits you, or wanted advice about the application, Countries Bank’s knowledgeable loan officials were there to guide you.

5. Regional Presence

While the Nations Bank is actually grounded on this new The southern part of and you can Midwest, their mortgage items are particularly tailored to generally meet the needs of homebuyers when it comes to those nations. Which have a robust regional visibility, Regions https://simplycashadvance.net/loans/instant-funding/ Financial knows the initial housing industry on these elements, providing alternatives that most other federal banking institutions get neglect.

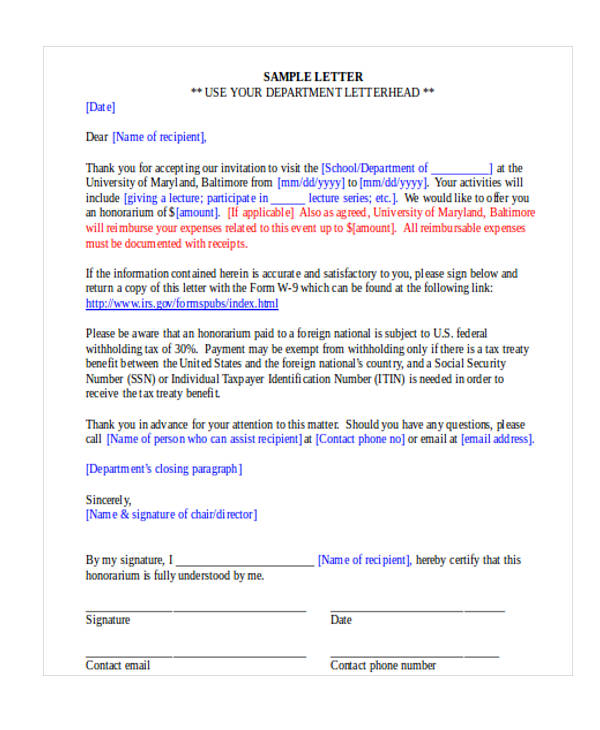

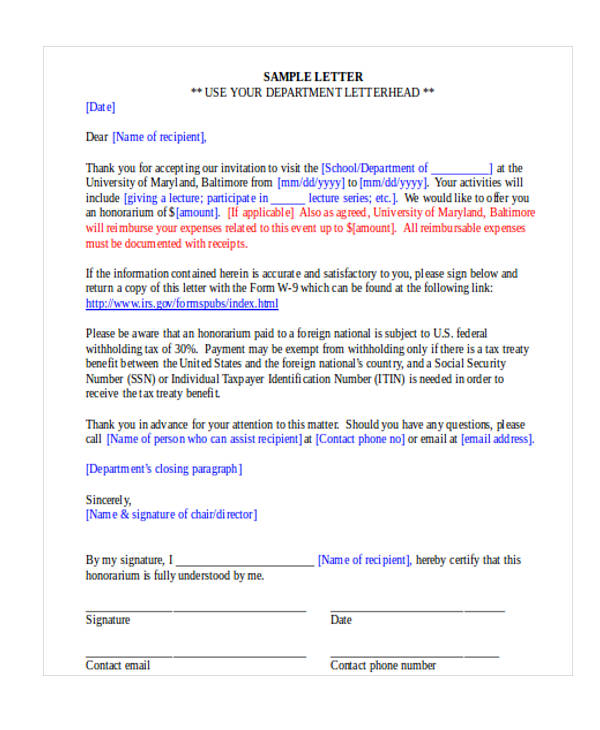

Tips Submit an application for a regions Financial

Applying for a home loan that have Countries Bank is an easy procedure. Listed here is one step-by-step self-help guide to help you to get already been:

Pre-Qualification: In advance finding belongings, score pre-entitled to a home loan that have Countries Home loan. This can help you regulate how far house you really can afford and you will reveals vendors that you’re a serious client.

Application for the loan: Immediately following you will be in a position, you might make an application for a mortgage online or even in individual during the a regions Financial branch. You will need to provide information that is personal, economic files, and you can information about the house you find attractive to acquire.

Mortgage Recognition: Immediately after distribution the application, Nations Mortgage usually review debt guidance and you can credit rating. Once accepted, they will present mortgage terminology according to your official certification.

Closing: Once everything is signed, Regions Financial commonly schedule a closing date, where you are able to sign all the required documents, pay any settlement costs, and you will technically end up being a homeowner.

Refinancing having Countries Mortgage

Along with family buy fund, Regions Financial also provides refinancing alternatives. Whether or not you want to reduce your interest rate, switch away from a changeable-rate financial so you’re able to a fixed-speed mortgage, otherwise tap into their residence’s guarantee, Nations Financial makes it possible to achieve your refinancing requires.

Achievement

Selecting the right financial the most extremely important economic conclusion you’ll make, and you may Places Mortgage provides a variety of choices to make it easier to fund your dream household. Which have aggressive rates, flexible financing solutions, and you can a consumer-earliest approach, Regions Financial try a reliable mate to have homeowners and you will property owners alike. Whether you’re to get property, refinancing, or looking to suggestions about the mortgage alternatives, Nations Home loan comes with the possibilities to help you each step off how.

From the dealing with Regions Bank, you can be confident that the mortgage requires will be fulfilled which have reliability and proper care. Talk about the choices today, and you can assist Nations Mortgage make it easier to go homeownership.