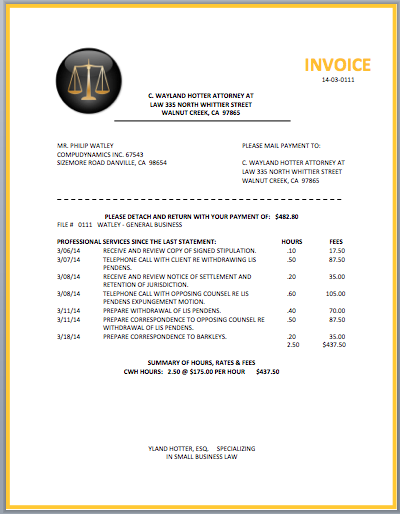

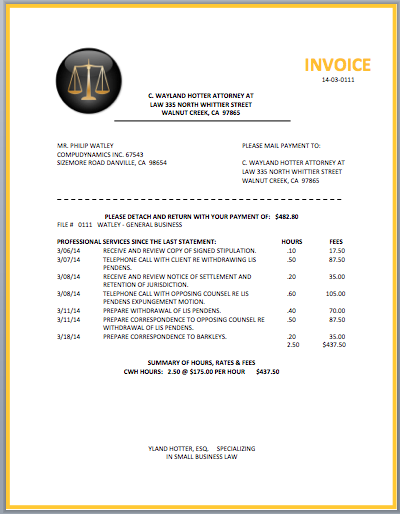

Content

Using this financial program, you can improve your newest antique otherwise Virtual assistant financing that have an excellent brand new Virtual assistant financing and become your own house’s left collateral towards the bucks. Upcoming, you are able to the money when it comes down to objective, particularly debt consolidation reduction or home improvements.

From the refinancing, you can get a separate Virtual assistant financial to possess $three hundred,000 to repay your existing financial or take $75,000 within the cash.

The amount personal loan companies in Windsor of bucks you can pull out depends on several factors, including the property value your house, your a good financial harmony, brand new closing costs, and the lender’s procedures.

In this post, I shall information the application form standards and feature you how it truly does work in order to decide if the new Va dollars-aside home mortgage refinance loan suits you.

What’s a great Virtual assistant cash-away refinance?

A good Va dollars-away home mortgage refinance loan was a mortgage secured because of the You.S. Agency out of Pros Issues (VA) to possess army experts, active obligation provider participants, and their spouses.

It allows you to refinance your Virtual assistant or low-Va mortgage and you may tap into brand new equity you’ve collected for the your house. You could potentially typically take-out a loan all the way to 100% of one’s value of your property without one a good mortgage harmony and you may closing costs.

not, the guidelines are very different depending on the lender, so it’s a good idea to consult a number of lenders to discover the best offer. You can find considerably more details regarding the Va-supported dollars-away home mortgage refinance loan on the VA’s site.

The following analogy reveals exactly how an effective 100% Va cash-away re-finance my work: their residence’s worth $300,000, your Virtual assistant loan harmony are $225,000, and you have $75,000 in home collateral.

Can you imagine we wish to make use of house’s equity to pay from large-notice mastercard expenses. You will be qualified to receive a great Virtual assistant financing, your credit score try 680, and you also qualify for the fresh Va dollars-aside refinance.

- $3 hundred,000 the fresh Va amount borrowed

- – $225,000 latest Virtual assistant loan balance

- – $dos,eight hundred estimated closing costs

- – $ten,800 Va financing payment

- = $61,800 bucks for you on closing

Very first, deduct the modern Virtual assistant loan balance and you will settlement costs, such as the Va investment fee, on the the fresh new Virtual assistant loan amount. Then, you have made $61,800 from inside the cash in the closing to repay their handmade cards.

Once more, this is just an illustration. Your own Virtual assistant dollars-out refinance loan’s specific terminology trust your financial as well as your novel problem. Have fun with all of our calculator observe latest rates of interest, yearly payment cost (APR), and estimated settlement costs.

- Have a look at closing costs, like the investment commission. Rating appropriate information, so that you understand what to anticipate whenever refinancing your house.

Would Virtual assistant cash-out loans need an assessment?

Good Va bucks-aside refinance loan need an assessment to decide their home’s latest value and you may security and you aren’t borrowing from the bank more than their house is value.

The financial institution requests the fresh assessment within the loan process. The fresh appraiser visits your home, inspects they, and prepares research the financial institution uses to calculate your loan amount.

The worth of your residence, due to the fact dependent on the new appraisal, may vary about price you repaid otherwise what you believe its worthy of. Nevertheless, new appraised worth impacts the amount of dollars you could potentially need aside when you refinance, making it a good idea to has an authentic knowledge of your house’s worthy of before you apply getting a good Virtual assistant cash-aside refinance.

Were there settlement costs towards the a beneficial Va dollars-aside refinance?

Brand new Virtual assistant dollars-aside home mortgage refinance loan features settlement costs, just as with any other kind off home loan refinance. Settlement costs was costs to cover the costs associated with refinancing your house. They’re able to are very different based their lender and the particular words of one’s loan, making it a good idea to research rates and you can examine now offers out of multiple lenders for the best price.